Good news for those who work and live in Philadelphia: the difference in your tax burden and that of your suburban counterparts is closer than it was a dozen years ago.

That’s according to a new report from The Pew Charitable Trusts’ Philadelphia Research Initiative. The report analyzed the residential tax burden, meaning the percentage of residents’ income spent on state and local income taxes, sales and property taxes.

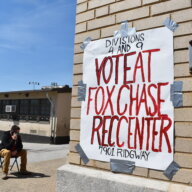

In comparing Philadelphia and 236 suburban municipalities in Pennsylvania and New Jersey, the tax burden in the city was the 48th-highest, compared to third-highest in 2000. The figures are based on a home-owning family of four with the median income.

The reason for the improvement? The city lagged behind most of the suburbs in raising property assessments in line with market values over the past 12 years. Philadelphia has also reduced its wage tax slightly, while many Pennsylvania suburbs raised their earned income taxes, according to the report.

The highest tax burden was paid by those who live in the suburbs but work in the city, the report said. Those commuters paid the higher property taxes, but were also subject to the city’s nonresident wage tax.

Specifically, in Philadelphia, the hypothetical family’s tax burden fell from 13.5 percent in 2000 to 12.9 percent in 2012. For a family living and working in the Pennsylvania suburbs, the tax burden rose from 9.8 percent to 12.2 percent. For a family living and working in the New Jersey suburbs, the tax burden jumped from 9.9 percent to 11.3 percent.

The full report can be viewed here.