By Jonathan Leff and Robert Gibbons

NEW YORK (Reuters) – Big money investors are calling a bottom in oil prices, U.S. government data showed on Friday, with hedge fund heavyweight Andy Hall predicting “much stronger prices” from the second half onwards. Money managers and other big speculators in U.S. crude oil futures and options raised net long positions that call for higher prices by some 52 million barrels in the week to April 7, data from the U.S. Commodity Futures Trading Commission showed. That was the biggest one-week rise in bullish bets since 2011, according to CFTC data.

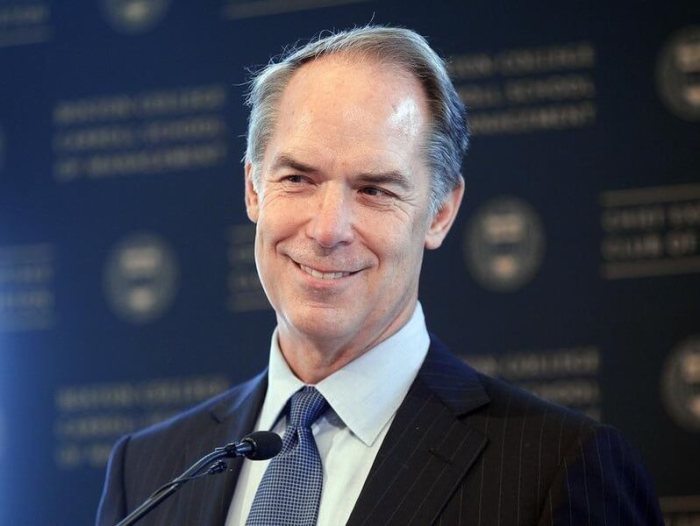

The data affirmed a growing notion that some of the biggest investors have started betting on a rebound after a seven-month price rout that subsided in January – something Hall asserted in this month’s letter to investors in his hedge fund. “The seasonal pickup in H2 demand should mean much stronger prices down the road,” Hall, who manages the $3 billion Astenbeck Capital Management in Westport, Connecticut, said in the letter, a copy of which was reviewed by Reuters on Friday. Hall conceded that the U.S. and global oil markets were oversupplied and Astenbeck had been too quick in the past to add to bullish bets, evidenced by its back-to-back losses in February and March that left the fund down 1 percent on the year. But he said there was “plenty of evidence that supply and demand are responding meaningfully to the 50 to 60 percent fall in prices since last summer.”

“The response to lower prices is more measured but will ultimately be equally dramatic,” he added.

The speculator group tracked by the CFTC data raised its combined futures and options position in New York and London by 51,802 contracts to 224,689 during the period, the biggest net long position since last August. The buildup in positions came during a five-day rally during which U.S. oil futures gained some 14 percent to close at $54.13 a barrel, their highest in 2015. The next day, however, prices slumped and are down more than half from June 2014 highs above $107. About one-third of the increase came from new long bets, pushing managed money’s long-only positions to the largest since July.

But a much larger share, some 33,000 lots, came from traders closing short positions that had ballooned to their highest on record just a few weeks earlier. Those traders may have given up waiting for another slump in prices amid signs of slowing U.S. supply growth and surprisingly robust demand. (Additional reporting by Barani Krishnan; Editing by Ted Botha and Lisa Shumaker)