By Leika Kihara

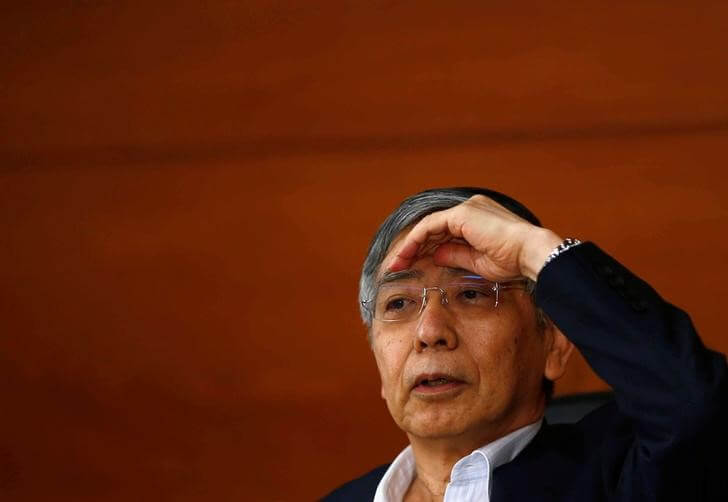

TOKYO (Reuters) – The Bank of Japan cut its assessment for two of Japan’s nine regions and said the market turmoil sparked by the Brexit vote could hurt consumer sentiment, signaling concern a strong yen and weak spending could derail a fragile economic recovery. The central bank also warned that an increasing number of Japanese firms were delaying price hikes on slumping demand, acknowledging that its massive money printing has not eradicated Japan’s sticky deflationary mindset. “Some companies worry that recent market instability, including recent yen rises and stock price falls, could further dent consumer sentiment,” the BOJ said in a quarterly report on the regional economy on Thursday. BOJ Governor Haruhiko Kuroda maintained his optimistic view of the economy and reiterated readiness to expand stimulus if needed to achieve his 2 percent inflation target.

“Japan’s economy is expected to expand moderately as a trend,” Kuroda told a quarterly meeting of BOJ regional branch managers.

But the BOJ cut its economic assessment for two regions, including the southern Kyushu area hit by a devastating earthquake in April, in the report, issued after the meeting, that covers the past quarter. It also offered a gloomier view on private consumption than three months ago for four regions, as department stores and automakers complained of weakening sales.

Speculation is swirling in markets that the BOJ will ease policy at its rate review this month as weak consumption, a strong yen and external headwinds weigh on the economy and push inflation further away from its goal. Britain’s shock vote to leave the European Union has accelerated the yen’s rise and pushed down Tokyo stocks, heightening expectations of near-term BOJ action.

PERSISTING IMPACT SEEN

“It’s not as if Brexit would lead to a sudden evaporation of demand. But companies are worried that uncertainty over the fallout from Brexit will persist for a long time,” Atsushi Miyanoya, the BOJ’s branch manager overseeing the Kinki western Japan region, told reporters. Miyanoya also said the yen’s recent rises were hurting business sentiment and corporate profits in his region, home to electronic giants such as Panasonic <6752.T>.

While the BOJ report said many regional economies continued to recover moderately, it warned that recent stock price falls and consumers’ pessimism over the outlook were hurting retail sales. Spending among overseas tourists also slowed due to the strong yen, the report said. “Consumers are becoming more selective… and fewer companies are resorting to the kind of price hikes seen last year,” it said.

The BOJ has kept monetary policy steady since January, when it decided to add negative rates to its massive asset-buying program in a fresh attempt to accelerate inflation.

The central bank has said its aggressive money printing will spur public expectations of future price hikes, and encourage households and companies to spend more rather than save.

While external headwinds have clouded the outlook for Japan’s export-reliant economy, BOJ officials have justified inaction by pointing to what they saw as “resilience” in domestic demand that will gradually lead to higher inflation. (Reporting by Leika Kihara; Editing by Shri Navaratnam and Richard Borsuk)

BOJ gloomier on consumption, warns of hit from Brexit

By Leika Kihara