If tax credits had the sex appeal as lottery winnings, people would be lining up around the block for them. But it just doesn’t work like that.

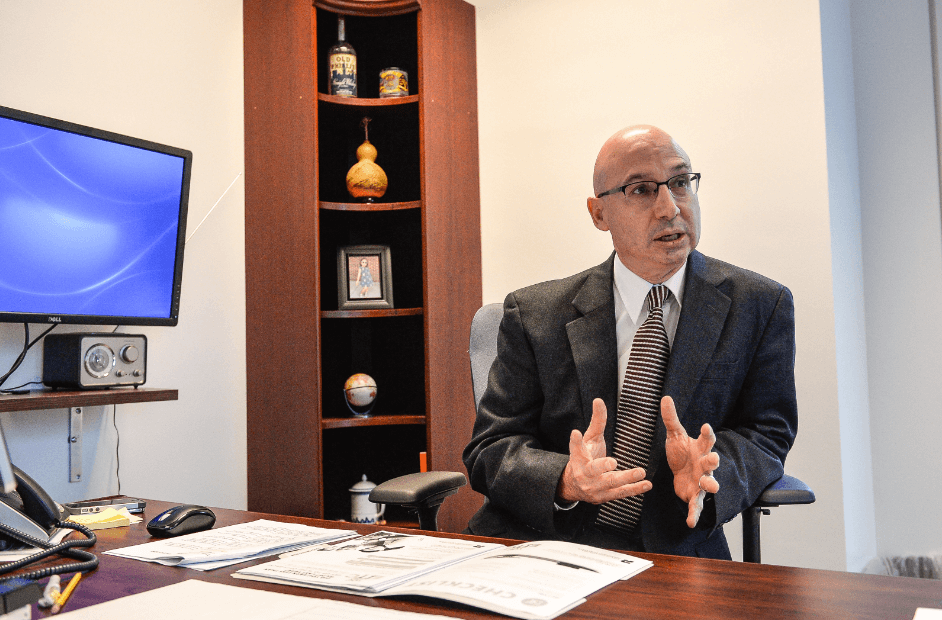

That’s the sad truth, says PhiladelphiaRevenue Commissioner Frank Breslin.

The city is at the peak of a new push to get the word out about roughly $100 million in unclaimed federal Earned Income Tax Credit (EITC) money that has been left on the table by Philadelphians who either simply don’t know about it or are too lazy to file the paperwork. RELATED:Six BenePhily Centers will provide assistance to low-income citizens “The credits range from around $500 to a maximum of$6,242. So, its serious money, and we estimate that there are about 40,000 taxpayers, residents of Philadelphia, who haven’t claimed the refund,” said Breslin. “I think people might think it’s too good to be true, or it’s too hard, or too complicated, too expensive to get tax preparation done, or they don’t trust a tax preparer. So what we’re trying to do is remove those barriers. We’re getting the word out.” It’s no secret many eyes start to glaze over when the words “tax credit” come up in conversation. But when that translates into dollar bills, people ought to start paying attention.

The average federal EITC refund amount available in Philly is more than $2,400, and the city’s revenue department estimates roughly 40,000 taxpayers don’t apply for it, leaving millions of dollars unclaimed. The city’s new outreach campaign, “You Earned It,” aims to make these residents aware of what they’re missing, as well as make it easier for them to file. “The Philadelphians who qualify for the federal EITC work hard, and many of them are challenged to make ends meet, support their loved ones and provide a quality life for their families,” said Mayor Jim F. Kenney. RELATED:A meeting of minds: Bloggers and city officials

“Whether it’s a few hundred dollars or a couple thousand, this extra money can make a huge difference in their lives. So, we need to get the word out.”

Breslin said another deterrent to people dragging their feet in applying is in not knowing how. Many times, those qualified – low-income folks – struggle with language barriers and transportation hurdles. That’s why the city has put in place 30 free tax preparation locations in neighborhoods throughout the city, close to public transportation and handled by IRS-certified tax preparers. “If it was a $100-million lottery jackpot, people would be excited, running to get tickets. But here we know there about 40,000 Philadelphians who are eligible for a piece of that,” said Breslin. He also added that some may find out they were eligible in prior years and hadn’t claimed it. They can amend and file returns going back as many as three years.

And that’s a lot of dough.

For more information, go to youearneditphilly.com.

City wants 40,000 Philadelphians to get what’s coming to them: Their money