(Reuters) – Authentic Brands Group Inc on Tuesday filed for a U.S. initial public offering following a year that saw the parent of apparel chain Aéropostale and Sports Illustrated magazine post strong earnings growth.

In a regulatory filing, Authentic Brands listed asset manager BlackRock Inc, U.S. private equity firm General Atlantic LLC and mall owner Simon Property Group Inc among its shareholders.

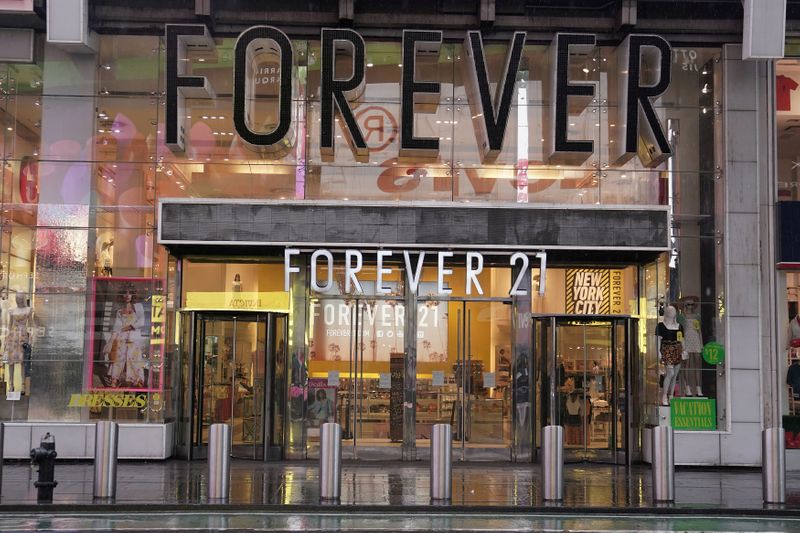

Authentic Brands, which also owns the Forever 21 brand, plans to list its stock on the New York Stock Exchange under the symbol “AUTH”, it said in a regulatory filing.

The company’s 2020 net income jumped to about $211 million from $72.5 million a year earlier, while its revenue rose

nearly 2% to $488.9 million.

The firm was targeting a valuation of about $10 billion in its IPO, CNBC reported in May, citing a person familiar with the matter.

At a time when peers like PVH are streamlining their portfolios by selling off brands, Authentic Brands Group has rapidly amassed over 30 labels that are sold at about 6,000 stores. Its rich portfolio of brands include those in media, entertainment, fashion, home, active and outdoor lifestyle sectors.

Authentic Brands Group last month entered into a deal with Calvin Klein owner PVH Corp to buy Izod, Van Heusen, Arrow and Geoffrey Beene trademarks in a deal valued at about $220 million.

The Nautica brand owner also said in the filing it intended to buy more brands, with opportunities within lifestyle, entertainment and other new areas.

BofA Securities, J.P. Morgan and Goldman Sachs & Co LLC are among the lead underwriters to the IPO.

(Reporting by Praveen Paramasivam in Bengaluru; Editing by Maju Samuel)