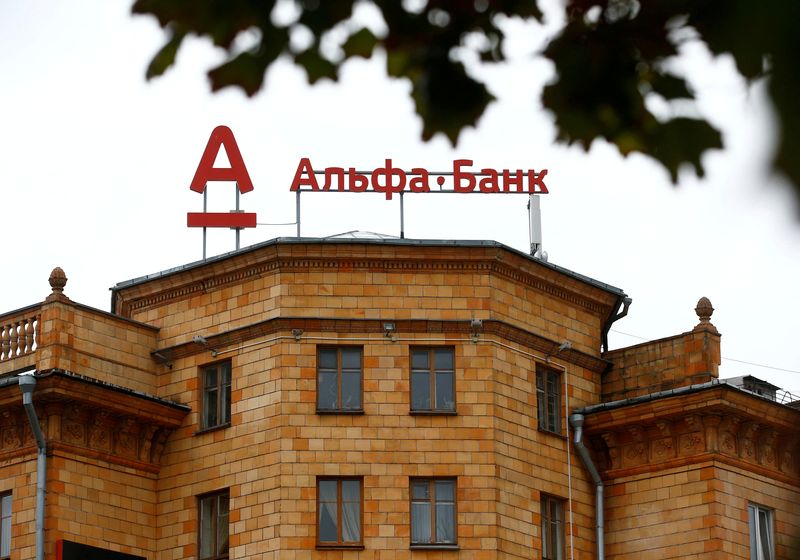

AMSTERDAM (Reuters) – Amsterdam Trade Bank (ATB), a subsidiary of Russia’s Alfa Bank, has been declared bankrupt, the Dutch central bank (DNB) said on Friday, citing an Amsterdam District Court Ruling.

A statement on the DNB website said ATB depositors would be covered up to 100,000 euros ($108,000) each under the Netherlands’ deposit guarantee system. The bank had around 23,000 customers, of whom most are Dutch but 6,000 are German, the DNB said.

According to filings at the Dutch Chamber of Commerce, the bank’s ultimate beneficial owner is Mikhail Fridman, the Russian-Israeli billionaire who is contesting Western sanctions imposed on him following Russia’s invasion of Ukraine. His stake in ATB was said to be more than 25% but no more than 50%.

Alfa Bank is subject to U.S. sanctions, but has not been targeted by the European Union.

ATB itself had not been sanctioned, but Dutch financial newspaper Het Financieele Dagblad (FD) reported that depositors began to panic on Thursday.

In a statement on its website, ATB confirmed it had requested and been granted bankruptcy. The bank said that U.S. and British sanctions had “caused operational difficulties, as the majority of ATB’s counterparties, including corresponding banks … find it difficult to continue supporting ATB.”

The FD newspaper had previously reported that ATB’s owners were seeking to sell the bank and depositors discovered that other European banks were unwilling to accept transfers out of ATB for fear of falling foul of sanctions.

The small bank had previously been known for trade financing but had sought in recent years to become a lender to small and medium size companies.

According to its 2020 annual report, the most recent on record at the Chamber of Commerce, ATB had assets of around 1.2 billion euros and equity of 174 million euros. It made a profit of 27 million euros that year.

($1 = 0.9270 euros)

(Reporting by Toby Sterling Editing by Louise Heavens and Mark Potter)