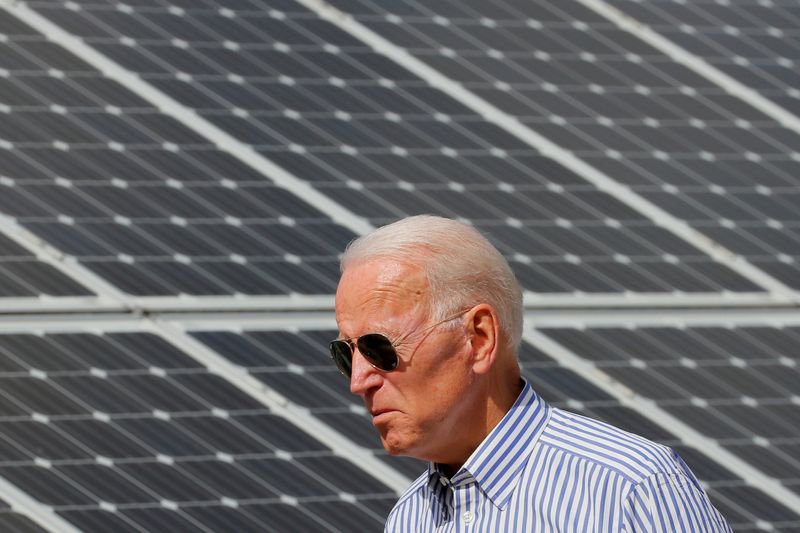

NEW YORK/BOSTON (Reuters) – Progressive groups and investors hope Democratic presidential nominee Joe Biden can win on Tuesday and quickly end Trump administration rules that stifle their ability to pick stocks using environmental, social or governance factors, setting up a renewed fight with corporate groups that backed the changes.

More than a dozen lobbyists, investors and policy experts said a Biden win could boost U.S. growth of environmental, social and governance (ESG) investing which lags far behind Europe, and which has been further stymied as Trump-appointed officials have crafted financial rules targeting shareholder voting and pension fund allocations.

ESG investing is winning more investor cash, boosted by studies showing superior performance.

But Trump’s Securities and Exchange Commission (SEC) and Labor Department rules put the United States at odds with major investors and further behind European funds, which held 82% of the global total of $1.26 trillion of ESG assets in the third quarter of 2020, according to Morningstar. U.S. funds held 14%.

Democrats favor so-called ESG investing strategies as a way to pressure companies to address climate change, wealth inequality and racial justice problems. If Biden takes the White House, investors expect him to prioritize aggressive reforms.

“The Trump administration and his regulators have been ideologically anti-ESG and climate from the start,” said Dennis Kelleher, president of progressive think tank Better Markets.

“This will change significantly if Biden wins. His administration will prioritize addressing climate change and will also boost ESG disclosure and promotion.”

In July, the SEC imposed new restrictions on proxy advisory firms that recommend how investors should vote in corporate elections. Critics of these firms said they had amassed too much power over the voting process and needed to be reined in.

In September, the SEC raised stock ownership requirements for submitting shareholder proposals, making it harder for advocates to get motions onto corporate ballots. The agency said the rules needed to be modernized.

On Friday, the Labor Department finalized a rule limiting some fund managers from investing in companies based on environmental or social factors, unless they could show an economic reason to do so. A similar rule on proxy voting is pending. The proposals cover trillions of dollars in retirement accounts. [nL1N2HL2DZ]

The U.S. Chamber of Commerce, the country’s most powerful business group, said in a memo last month that the rules showed its campaign for policies that benefit shareholders while opposing special interest activists was “bearing fruit.”

But investors and labor unions have blasted the changes.

Together, they put “limits on investors’ ability to hold companies accountable,” said Kyle Seeley, corporate governance officer for pension funds overseen by the New York State Comptroller.

If Democrats win the U.S. Senate, they could rescind the measures using a law that allows a new Congress to overturn freshly inked rules. If the Republicans retain their Senate majority, Biden could pick new agency heads who would revisit the rules or introduce countervailing measures, said policy experts.

Chief among those would be new rules requiring companies to issue ESG reports and disclosures, which Democratic SEC commissioner Allison Lee has argued for. Lee, who opposed the SEC changes, is likely to be SEC acting chair if Biden wins.

Mindy Lubber, chief executive of sustainability advocacy group Ceres, said her group has spoken with the Biden campaign about introducing such disclosures, as well as regulations requiring banks to stress-test their balance sheets for climate-related risks. She added that she expected corporate groups would fight any effort to rescind the SEC and Labor Department changes.

Lee and Biden’s campaign did not immediately respond to a request for comment.

DEEP POCKETS

Since the 2009 financial crisis, top investors have focused more on executive compensation and environmental issues, sparking a backlash from oil majors including ExxonMobil Corp and Chevron Corp which faced investor pressure to explain how climate change could hurt their businesses.

Oil companies have for years underperformed other industrial sectors and the S&P 500.

The oil giants and other deep-pocketed groups, such as the Chamber and the National Association of Manufacturers (NAM), pushed hard in Washington for the SEC rules for several years, according to three regulatory sources with knowledge of the matter, several lobbyists, and public records and letters.

As the SEC began exploring the rule changes in 2018, for example, the Chamber and NAM launched a six-figure advertising and social media blitz saying proxy advisors harmed retirees and gave politically-motivated advice, claims those companies deny.

The Chamber also pushed the Labor Department to make changes, according to three other sources and public letters.

Exxon declined to comment. A Chevron spokesperson said limits on shareholder proposals are “justified” and that the company aims to be transparent and responsive on ESG issues.

The Labor Department did not comment.

An SEC spokesperson said its rules enhance transparency and the “fiduciary duties and disclosure obligations owed to shareholders” without materially changing their ability to access proxy advice or get proposals on the ballot.

The Chamber and manufacturers association said the SEC and Labor Department rules increase transparency around the investment process, and guard workers’ pensions from the political whims of interest groups.

For those reasons, said Tom Quaadman, an executive at the Chamber, the rules resonate with both Republicans and Democrats. He said he expects some moderate Democrats to oppose an attempt to overhaul them.

“We will be prepared to defend the rules if they’re challenged,” said Charles Crain, a director at NAM.

(Editing by Michelle Price; Additional reporting by Simon Jessop, Trevor Hunnicutt and Katanga Johnson; Editing by David Gregorio)