By Greg Roumeliotis and Herbert Lash

(Reuters) – It took Blackstone Group LP less than four weeks after an approach from General Electric Co to clinch the biggest real estate deal since the financial crisis. Yet the seeds of that deal were planted seven years ago, during the crisis. After the Wall Street meltdown, U.S. regulators slapped rules on banks and other financial institutions aimed at curbing their risk taking. These requirements, including more burdensome capital requirements and the hiring of additional compliance staff, have raised the costs of real estate investing, driving some out of the business and prompting others to cut back. As part of a wider restructuring, GE announced on Friday it would sell most of the assets of its GE Capital Real Estate unit to Blackstone and Wells Fargo & Co for about $23 billion.

This move away from finance operations will allow GE to break free from the regulatory constraints that came from its designation as a systemically important financial institution (SIFI).

The Financial Stability Oversight Council, a panel of regulators created after the financial crisis, has already labeled four non-bank financial firms such as large insurers as SIFIs. It has now set its sights on the asset management industry, reviewing whether activities and products offered by firms such as BlackRock Inc and Fidelity Investments may pose risks to the broader economy. Blackstone, however, is smaller than such traditional asset managers. It said in its latest annual report it considers it unlikely it would be designated a SIFI.

Major financial institutions such as Morgan Stanley, Goldman Sachs Group Inc and American International Group Inc have all scaled backed their real estate investment operations since 2007.

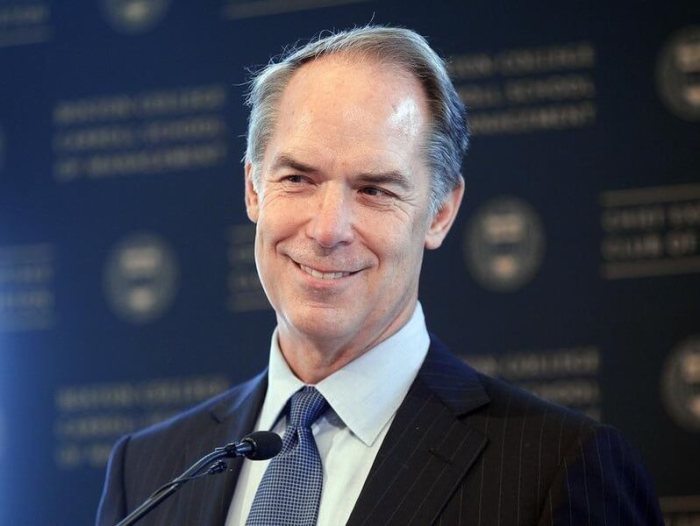

Blackstone stepped into the void. Its real estate business grew from $18 billion in assets under management in 2007, a year before a housing market bust triggered the crisis, to $80.9 billion as of the end of last December. “We have very consciously looked at where the banks are pulling back, or we spent a lot of time looking at the bank regulations… thinking okay, well that’s a market that used to be a bank-driven market, they will pull back or they will change their pricing,” Blackstone Chief Financial Officer Laurence Tosi told the Credit Suisse Group Financial Services Forum in February. Blackstone and other alternative asset managers have largely stayed below the regulators’ radar thanks to their structure. Unlike banks, Blackstone does not take deposits. The investors in its funds agree to lock up their money for 10 to 12 years, so there is no risk of sudden outflows, reducing the possibility of systemic risk to the financial system. Blackstone’s private real estate funds draw institutional holders such as public pension funds and insurance firms, while its real estate investment trusts attract retail investors.

The GE deal is Blackstone’s largest since it acquired office landlord Equity Office Properties Trust from Chicago real estate magnate Samuel Zell in 2007 for $39 billion, including debt.

EXISTING RELATIONSHIP

Blackstone had already bought about $6 billion in assets from GE in recent years, including Australian office buildings and Japanese apartments. GE Capital has also been a major financier of Blackstone’s real estate deals. GE reached out to Blackstone in mid-March, seeking a buyer with a big real estate platform with the capacity to buy bothequity and debt property assets, according to people close to the deal.

“The distance between Blackstone and everyone else is like the Grand Canyon,” said an investment banker who has advised the company.

The deal values the assets at book value, with a built-in mechanism to mitigate Blackstone’s risk for buying them with limited due diligence, one of the people added. It would otherwise have taken months to assess each property. It is unclear what that mechanism entails. Blackstone is acquiring roughly 24 million square feet of office properties in the U.S. and 18 million square feet of office, logistics and shopping malls in Europe. It also agreed to purchase loans in the United States, Mexico and Australia. From single-family homes in the United States to distressed commercial property in Europe, real estate has overtaken private equity as Blackstone’s most high-profile and lucrative business. It accounted for 43 percent of its economic net income in 2014. (Additional reporting by Sarah Lynch in Washington, D.C. and Mike Stone in New York; Editing by Martin Howell and Christian Plumb)