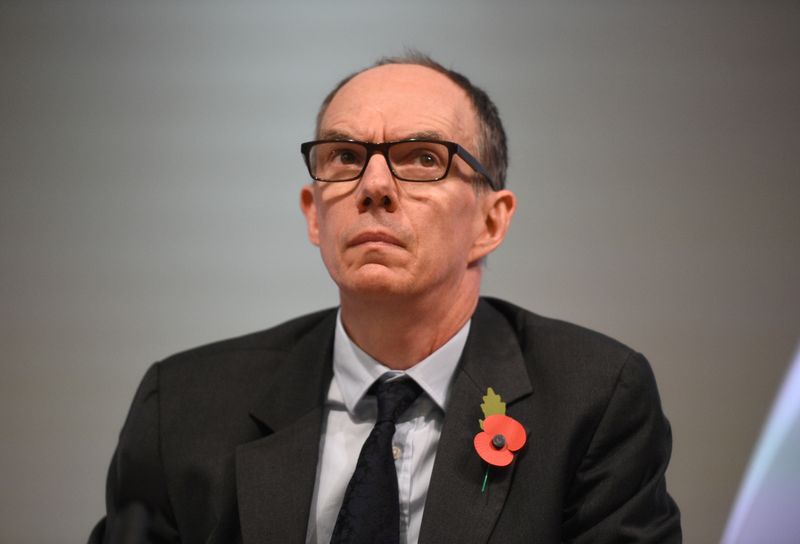

LONDON (Reuters) – Cutting interest rates below zero risks damaging British banks’ capacity to lend, and is not currently the right tool for the Bank of England to stimulate the economy, Deputy Governor Dave Ramsden said on Wednesday.

“While there might be an appropriate time to use negative rates, that time is not right now,” Ramsden said at the annual conference of Britain’s Society of Professional Economists, adding that asset purchases were a better way to boost demand.

Economists polled by Reuters expect the BoE to expand its asset purchase programme by 100 billion pounds ($131 billion) next month to 845 billion pounds, but do not expect it to cut rates below zero this year or next.

In August, BoE Governor Andrew Bailey said the central bank was looking more closely at negative interest rates – a tool used by the European Central Bank and Bank of Japan – but said no decision had been taken about whether it was viable.

While two external members of the BoE’s Monetary Policy Committee, Silvana Tenreyro and Gertjan Vlieghe, have spoken positively about cutting rates below zero, Ramsden and BoE Chief Economist Andy Haldane have both expressed doubts.

“There can be knock-on economic effects through the banking system. These effects could reduce or even counteract the stimulus from negative rates,” Ramsden said.

Negative rates could reduce banks’ incentive to lend, or not be passed on to borrowers.

Ramsden said his views were not set in stone, and that negative rates could be more attractive when there was less pressure on banks’ balance sheets.

But the structure of Britain’s banking system was different from the euro zone, so positive evidence there could not be directly applied in the British context, he added.

Ramsden said he was also worried about growing signs of higher unemployment, especially for younger people, and of long-term damage to the economy from the coronavirus pandemic.

“There is a real risk of a more persistent period of higher unemployment, and the recent strength in income growth might not be sustained,” he said.

“The negative impact on the supply side of the economy, or degree of scarring, could potentially be greater than the 1.5% we have assumed to date.”

(Reporting by David Milliken and Andy Bruce; editing by Stephen Addison)