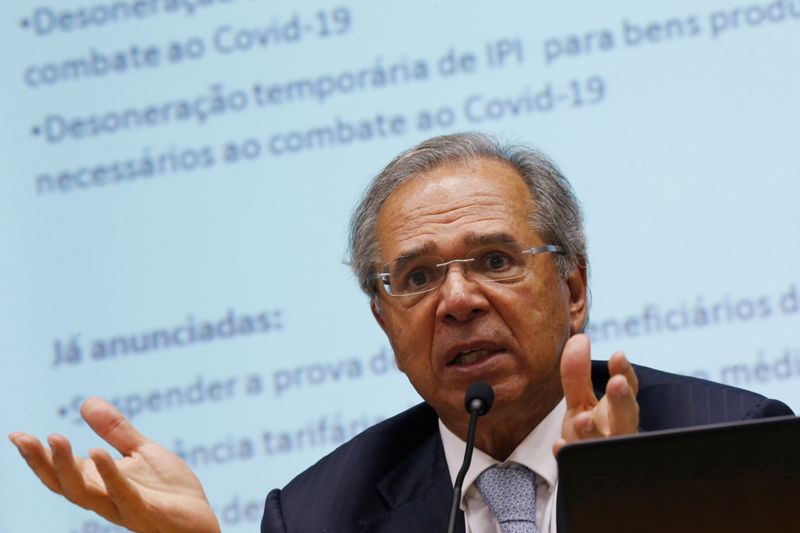

BRASILIA (Reuters) – Brazil’s real, one of the worst-performing currencies against the dollar this year, will strengthen when foreign investors are confident enough in the strength and durability of the country’s economic growth, Economy Minister Paulo Guedes said on Friday.

In a virtual address to a foreign trade conference, Guedes also said Brazilian exports remain very strong despite the global pandemic, and will be a key part of the economy’s wider recovery.

“When will the (dollar’s) exchange rate go down? When there is success to attract foreign investments, when they finally come in to help us in infrastructure, concessions and privatizations,” Guedes said.

“The (dollar) will go down as soon as foreign investment returns en masse, which will guarantee that Brazil has finally come back,” he added.

Brazil’s real has lost around 30% of its value against the dollar since January, making it one of the worst-performing currencies in the world this year. The dollar reached an all-time high near 6.00 reais in May, and topped 5.80 reais late last month.

A combination of official interest rates being slashed to a record low 2.00%, and growing concern over Brazil’s fiscal health as the government’s deficit and debt hits new peaks, have hit the real hard, analysts say.

Speaking shortly after a central bank indicator showed a solid rise in economic activity in the third quarter, Guedes reiterated his bullish view on the economy, in particular the pace of formal job growth.

“Brazil is coming out of recession. Job creation is so strong that it may be difficult to maintain that pace,” Guedes said, adding that total job losses resulting from the pandemic-fueled recession will be “much smaller” than in previous recessions.

More than 300,000 formal jobs were created in September, a record for that month as services sector employment finally started to pick up.

Other labor market indicators, however, are far less rosy and suggest unemployment and underemployment will continue to hit fresh highs in the coming months.

(Reporting by Jamie McGeever and Marcela Ayres; Editing by Alistair Bell)