(Reuters) – U.S. business activity growth slowed for a third straight month in August as capacity constraints, supply shortages and the rapidly spreading Delta variant of the coronavirus weaken the momentum of the rebound from last year’s pandemic-induced recession.

Data firm IHS Markit said on Monday its flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, fell to 55.4 – the lowest since last December – from 59.9 in July. A reading above 50 indicates growth in the private sector.

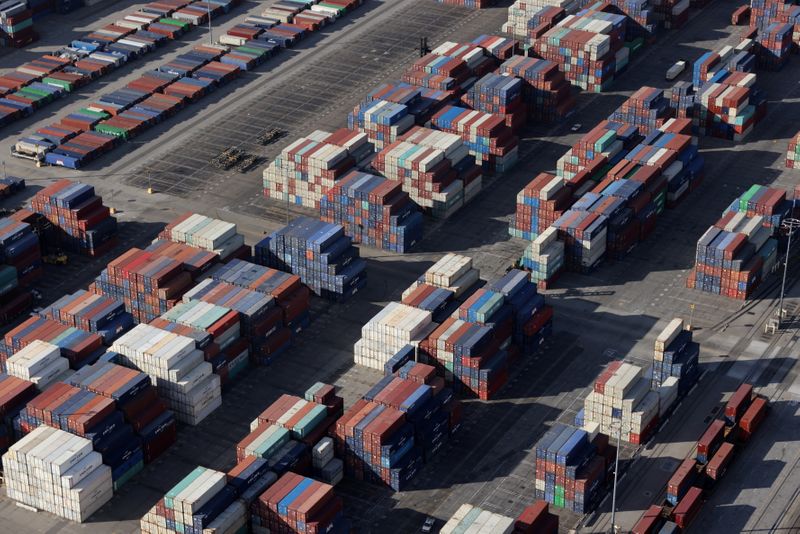

Shortages of raw materials and labor now appear to be holding back output as well as fanning inflation, according to the IHS Markit data. New order growth was the weakest so far this year, while employment grew at the slowest rate in more than a year.

“Not only have supply chain delays hit a new survey record high, but the August survey saw increasing frustrations in relation to hiring,” said Chris Williamson, chief business economist at IHS Markit. “Jobs growth waned to the lowest since July of last year as companies either failed to find suitable staff or existing workers switched jobs.”

The IHS Markit survey’s flash services sector PMI fell to a reading of 55.2 from 59.9 in July. Economists polled by Reuters had forecast a reading of 59.5 this month for the services sector, which accounts for more than two-thirds of U.S. economic activity.

The survey’s flash manufacturing PMI slid to 61.2 in August from July’s all-time high reading of 63.4. Economists had forecast the index for the sector, which accounts for 11.9% of the economy, would dip to 62.5.

IHS Markit’s measures of prices paid by services companies and manufacturers both rose, with factory input prices hitting another record high.

The survey’s findings dovetail with a growing view that the pace of economic expansion is tailing off after two successive quarters of growth above 6%, a back-to-back performance not seen since the 1980s and fueled by massive fiscal stimulus. Goldman Sachs economists, for example, last week slashed their third-quarter gross domestic product estimate to 5.5% from 9%, and the slowing momentum calls into question the consensus among Federal Reserve policymakers that growth would hit 7% this year.

JACKSON HOLE CONFERENCE

The Fed will hold its annual Jackson Hole economic symposium later this week in a virtual format for the second straight year due to the pandemic. Fed Chair Jerome Powell will speak on the economic outlook on Friday.

Powell’s remarks will be closely watched for any fresh signal on how soon the Fed may cut back on its crisis-era accommodation. That policy turn appears to be in the offing by the end of the year as the economy remains squarely in growth mode and inflation well over target despite the latest headwinds from the Delta variant and the fading boost from government spending. The labor market, for instance, has added roughly 1.9 million jobs in the past two months, although the IHS Markit data suggests that pace has cooled in August.

The government is due to publish its revised estimate of second-quarter GDP on Thursday, with economists polled by Reuters estimating growth to be marked up to an annualized rate of 6.7% from the advance estimate of 6.5%. The economy in the second quarter also regained a record level of output, recouping all of the record-setting drop triggered by the pandemic in just four quarters.

(Reporting by Dan Burns; Editing by Paul Simao)