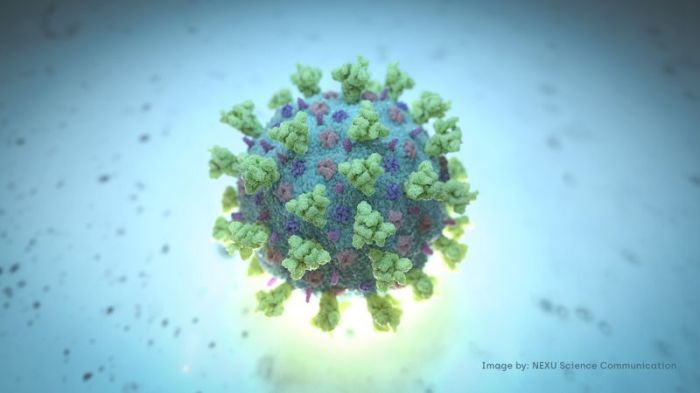

(Reuters) – European shares rose on Monday as progress on a possible COVID-19 vaccine, some upbeat earnings reports and stimulus talks fed into hopes of an economic recovery from the coronavirus-induced downturn.

The pan-European STOXX <.STOXX> index rose 1%, with miners <.SXPP> gaining 1.7% on optimism over China’s recovery and surging metal prices.

Other growth-oriented sectors such as travel & leisure <.SXTP>, banks <.SX7P>, technology stocks <.SX8P> and oil & gas <.SXEP> rose between 1.9% and 1.4%.

Two experimental coronavirus vaccines by German biotech firm BioNTech <BNTX.O> and U.S. pharmaceutical giant Pfizer <PFE.N> have received the U.S. Food and Drug Administration’s “fast track” designation, the companies said on Monday.

“The sooner a vaccine comes out the more confident economies can get about opening up completely and start to get on the road to recovery,” said Michael Baker, analyst at ETX Capital in London. He added that optimism also stems from the fact that the companies involved are ones with the capacity to mass-produce.

Shares of BioNTech’s depository receipt <22UAy.F> on the Frankfurt exchange jumped 13.5%.

This week also kicks off the U.S. and European quarterly earnings season and includes a summit over the European Union recovery fund and a European Central Bank policy meeting.

“There appears to be some optimism that forecasts have been lowered to such an extent that businesses will be able to clear this low bar and surpass expectations,” AJ Bell Investment Director Russ Mould said.

Companies listed on the STOXX 600 are expected to report a 54% drop in second-quarter profit, the worst ever reading for Europe, according to Refinitiv data.

Nordic bank DNB <DNB.OL> rose 9.9% after an earnings beat, while private security company G4S <GFS.L> gained 9.3% on announcing that first-half profit would surpass expectations.

While the ECB is not expected to make a major move, European leaders will meet on July 17-18 to hammer out details on the $750 billion euro recovery fund.

Financial markets have taken comfort from trillions of dollars in stimulus even as the World Health Organization reported a record increase in global coronavirus cases on Sunday.

In other company news, Finnish valves maker Neles <NELES.HE> surged 37.6% and hit a record high after Swedish industrial group Alfa Laval <ALFA.ST> announced a recommended 1.73 billion euro ($1.96 billion) cash bid.

Meanwhile, Atlantia <ATL.MI> slumped 15.2% after Italy’s prime minister dismissed the toll road operator’s bid to keep its lucrative toll road concession.

French video games group Ubisoft <UBIP.PA> fell 5% as it announced staff departures after a review in response to allegations of misconduct at the company.

(Reporting by Sruthi Shankar in Bengaluru; Editing by Shounak Dasgupta and Mark Heinrich)