(Reuters) – European stocks stabilised on Tuesday after their worst sell-off this year in the previous session, helped by a handful of positive corporate earnings and production updates from miners.

The pan-European STOXX 600 index rose 0.5%, after worries about the fast-spreading coronavirus Delta variant and slowing economic growth had knocked 2.3% off the index on Monday.

Miners, among sectors that bore the brunt of Monday’s bruising selloff, rose 1.2% after BHP Group and Anglo American provided upbeat production numbers.

Swiss bank UBS climbed 4.0% after it posted a 63% jump in second-quarter net profit, helped by a booming wealth management business. Peers Credit Suisse and Julius Baer also rose.

“Although the U.S. economy is in a slowdown phase and we expect European growth to peak this summer, we continue to favour risk assets over a 12-month horizon,” analysts at BCA Research wrote in a note.

“The UK is a case in point — broad-based vaccinations are keeping hospitalisation rates there low despite the sharp jump in COVID-19 infections. Thus, the market impact of the Delta variant may ultimately prove fleeting in developed economies.”

British airline easyJet gained 1.9% after saying it plans to fly 60% of its pre-pandemic capacity in the July-September period.

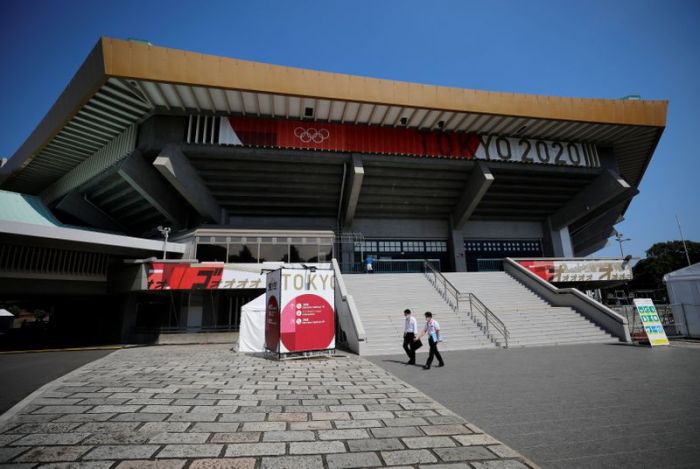

Europe’s travel & leisure index has fallen sharply from its April record highs, with travel-related stocks getting hit by soaring infections across the continent and last-minute changes to travel rules.

The U.S. government on Monday issued the highest warning against travel to Britain.

Graphic: Europe’s travel % leisure index drops 17% since April peak – https://fingfx.thomsonreuters.com/gfx/mkt/klpykeeqqpg/Pasted%20image%201626770849236.png

Among other stocks, Norwegian telecoms operator Telenor rose 2.3% after it raised its full-year revenue outlook.

French spirits group Remy Cointreau inched down 2.2% even as its first-quarter organic sales more than doubled after bars and restaurants reopened in Europe.

Analysts expect profit at STOX 600 companies to jump 108.6% in the second quarter versus a year ago, according to Refinitiv IBES estimates, as COVID-19 restrictions eased across Europe.

Sweden’s AB Volvo fell 3.5% as it warned of further production disruptions and stoppages this year due to chip shortages.

Home appliances maker Electrolux tumbled 9.4% after it reported a lower-than-expected second-quarter operating profit and warned global supply chain woes would worsen in coming months.

(Reporting by Sruthi Shankar in Bengaluru; Editing by Arun Koyyur, Uttaresh.V and Alex Richardson)