WASHINGTON (Reuters) – With Sarah Bloom Raskin last month dropping out of the running for the Federal Reserve’s top regulatory role, President Joe Biden’s administration is hunting again for a new candidate.

Raskin failed to garner enough support from moderate Democrats to be confirmed. Most notably, West Virginia Senator Joe Manchin said he would not back her, citing worries she would discourage banks from lending to oil and gas companies.

The Fed Vice Chair for Supervision role is one of the most powerful banking regulators in government, and the next official is likely to take on a sweeping portfolio including climate finance risk, fintechs, and fair lending.

Here are the candidates likely to be in the mix, according to analysts and Washington insiders.

MICHAEL BARR, FORMER TREASURY OFFICIAL

Michael Barr, currently a professor at the University of Michigan Law School, was a central figure at the Treasury under President Barack Obama when Congress passed the 2010 Dodd-Frank financial reform law.

As assistant secretary for financial institutions, Barr helped shape the Wall Street overhaul and now is a leading candidate to be nominated for the Fed role, according to two sources familiar with the matter.

Barr had previously been in the mix for another bank regulatory post, heading up the Office of the Comptroller of the Currency. But opposition from some progressives, who cited his work with some fintech firms after leaving government, helped sink his consideration.

Barr did not respond to a request for comment.

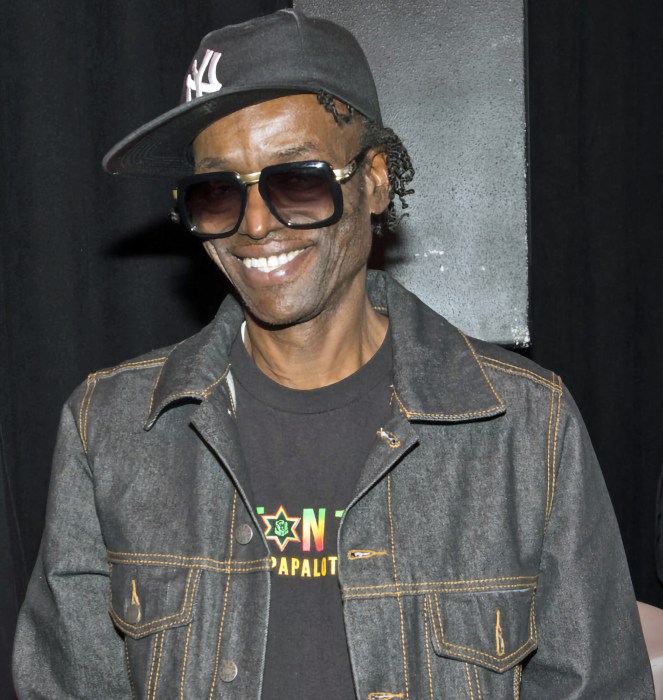

RAPHAEL BOSTIC, ATLANTA FED PRESIDENT

With his appointment as president of the Atlanta Fed in 2017, Bostic became the first Black person to hold a regional Fed president role. He has been outspoken on racial diversity and economic inequality issues, both of which are key policy priorities for the Biden administration.

An economist by training, Bostic previously held roles at the U.S. central bank in Washington, where he won praise for his work on community lending rules, and at the U.S. Department of Housing and Urban Development.

However, Bostic represents a bit of an unknown regarding financial regulation, analysts said. Even so, some banks were keen on Bostic for the role when his name was first floated last year, according to two industry executives.

A spokesperson for Bostic did not immediately provide comment.

NELLIE LIANG, TREASURY UNDERSECRETARY

Liang, a former Fed official who is now Treasury’s undersecretary for domestic finance, was instrumental in building the regulatory framework after the 2007-2009 recession and financial crisis. She spent decades at the Fed as a staffer, ultimately becoming the first director of the central bank’s Division of Financial Stability.

She left the Fed in 2017 to join the Brookings Institution think tank, where she criticized Republican efforts to trim capital and liquidity requirements for large banks, among other changes.

Liang was nominated for a seat on the Fed’s Board of Governors during the Trump administration, but she withdrew in 2019 after Republicans blocked her nomination over worries she would be too tough on Wall Street.

However, some progressives are unhappy that Liang has not taken a tougher stance on cryptocurrencies, “so it is unclear whether she would be in any future conversation about this role,” Isaac Boltansky, policy director for brokerage BTIG, wrote in a note on Monday.

A spokesperson for Liang did not immediately respond to a request for comment.

MICHAEL HSU, ACTING COMPTROLLER OF THE CURRENCY

Currently acting comptroller of the currency, Hsu previously led big bank supervision at the Fed. In his current role, he has pushed Democratic priorities, including climate change risk and has warned banks against “over-confidence” coming out of the COVID-19 pandemic.

While he would be a good fit for Fed supervision, Washington insiders said, it’s unclear if his stance on climate financial risk would be palatable to Manchin, a moderate who represents coal-producing West Virginia in the Senate.

A spokeswoman for Hsu did not immediately respond to a request to comment.

FORMER TREASURY UNDERSECRETARY MARY MILLER

A new name floated on Monday was Mary Miller, who was at the Treasury from 2010 to 2014. She recently served as the interim senior vice president for finance and administration at Johns Hopkins University.

During her stint at the Treasury, Miller was responsible for Treasury debt management, fiscal operations, and the recovery from the financial crisis. She played a central role in implementing the 2010 Dodd-Frank financial reform law, helping agencies write complex regulations like the “Volcker Rule” and standing up the new Financial Stability Oversight Council.

Miller could not immediately be reached for comment.

RICHARD CORDRAY, FORMER HEAD OF THE CONSUMER FINANCIAL PROTECTION BUREAU (CFPB)

A former Ohio attorney general, Cordray served as the first director of the CFPB.

Under his leadership the agency took an aggressive stance in going after abusive mortgage and payday lenders, earning praise from progressives and criticism from Republicans who said he was overstepping the agency’s statutory remit.

After leaving the agency, Cordray ran unsuccessfully for Ohio governor. He currently runs the Education Department’s federal student aid programs. Cordray was in the running for the supervision post late last year, Reuters reported.

Cordray did not respond to a request for comment.

(Reporting by Pete Schroeder)