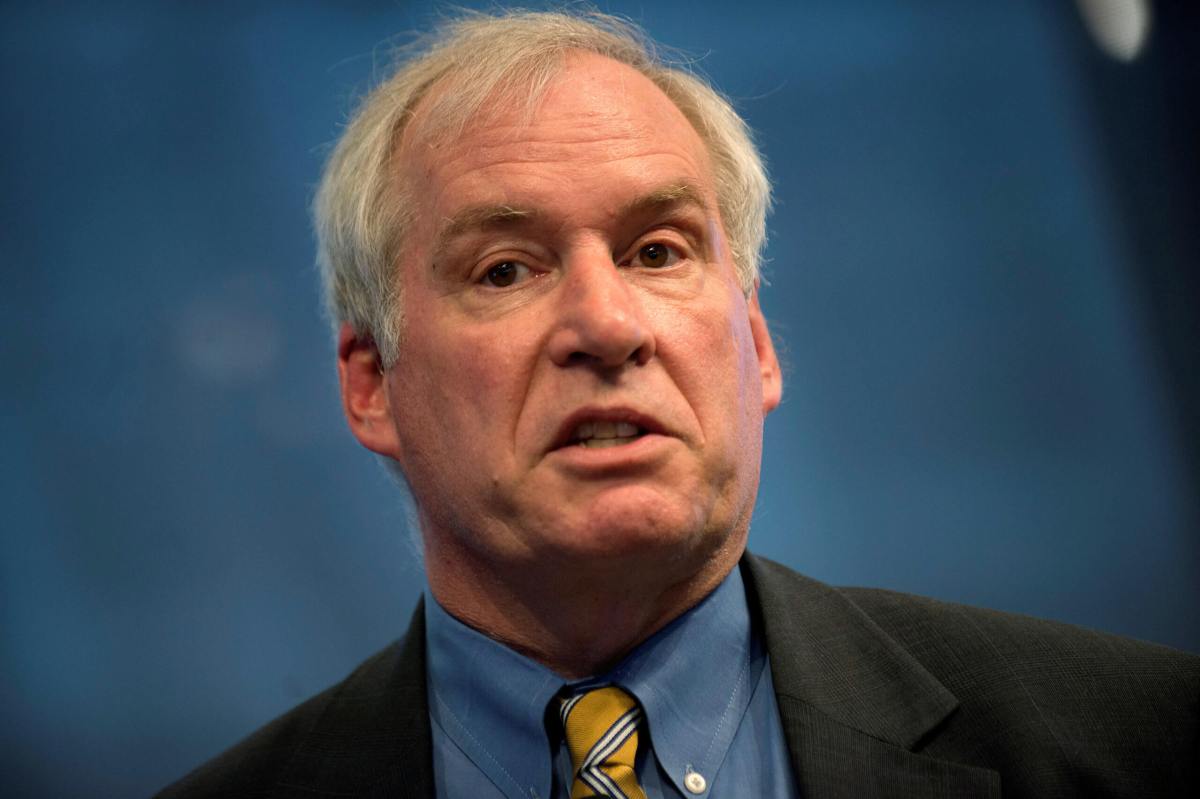

WASHINGTON (Reuters) – The Federal Reserve should be patient in assessing whether to cut interest rates and the strength of the U.S. consumer will be key, Boston Federal Reserve Bank President Eric Rosengren said on Friday.

“While U.S. consumers have been resilient to date, continued resilience is not guaranteed … my view is that policymakers can be patient and continue to evaluate incoming data before taking additional action,” Rosengren said in prepared remarks at the University of Wisconsin-Madison.

Rosengren, who has opposed the U.S. central bank’s two interest-rate cuts this year, said the main question was whether consumer spending can continue to offset the negative impact of the Trump administration’s trade wars and slowing global growth.

The United States was holding a second day of high-level trade talks with China on Friday in a bid to resolve their 15-month trade war.

Rosengren noted that despite those headwinds second-quarter U.S. economic growth was above the estimated long-term trend and that many economists continue to expect the economy to grow around its potential, but signaled that he was keeping an open mind on the future.

“My forecast for the economy does not envision additional easing being necessary. However, should risks materialize and economic growth slow materially, to below the potential rate, I would be prepared to support aggressive easing,” Rosengren said.

Fed policymakers voted 7-3 to cut interest rates at their last meeting in September and investors currently expect an additional quarter percentage point cut at the central bank’s next meeting on October 29-30.

Fed Chair Jerome Powell did little to push back against those expectations in a speech earlier this week while minutes of the Fed’s last meeting, released on Wednesday, made plain that deep divisions remain on the path ahead for monetary policy.

Rosengren said the economy was currently evolving as he expected despite the unanticipated increase in tariffs and slower growth of exports and business investment. The Fed’s two rate cuts are also “likely to provide some stimulus over the next several quarters,” he added.

(Reporting by Lindsay Dunsmuir; Editing by Andrea Ricci)