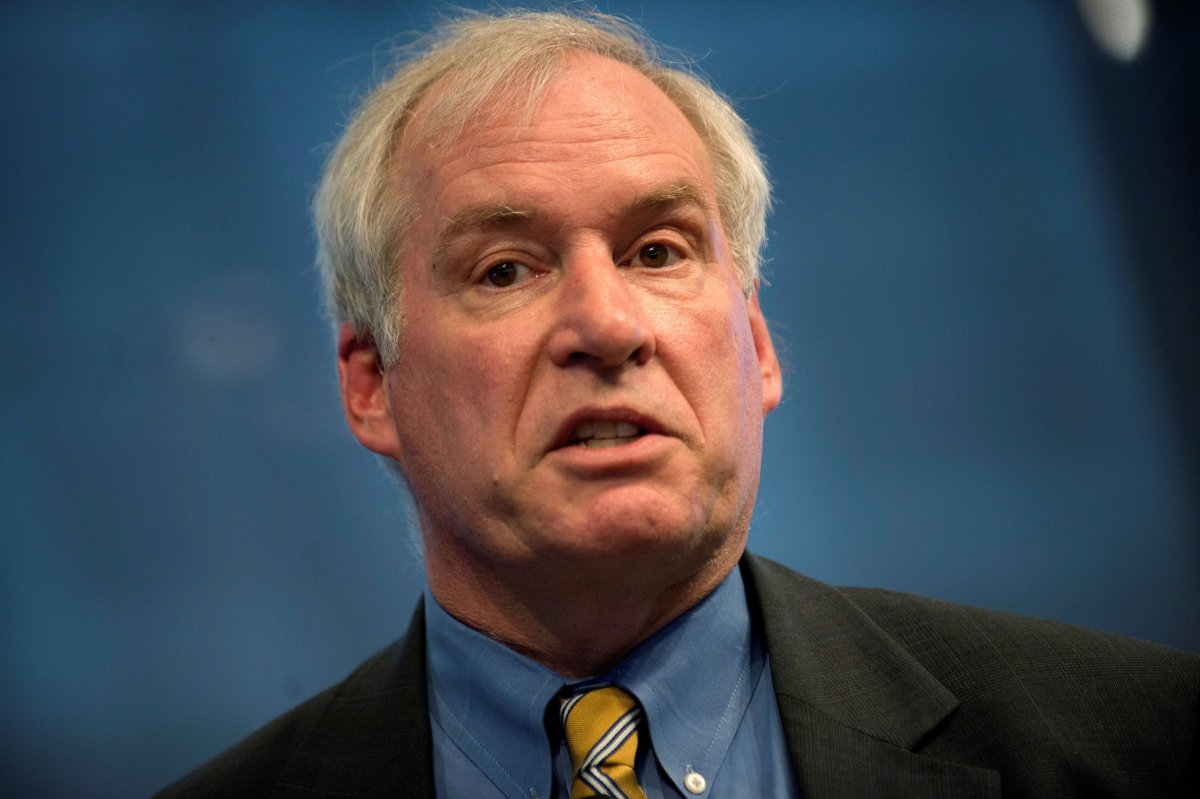

(Reuters) – The coronavirus crisis is likely to cut home and office building prices, may lead to a permanent shift in the demand for office space, and could push highly indebted households and companies toward default, Boston Federal Reserve bank president Eric Rosengren said on Wednesday.

His remarks in an online event with the Boston Chamber of Commerce offered a dimmer view of the financial challenges posed by the crisis than some of his colleagues who feel that if the health challenge is managed quickly a fast economic rebound will let the economy pick up roughly where it left off.

Rosengren, however, said he felt small businesses may be threatened even with promised federal aid. Forgivable loans from the Small Business administration are due to start flowing soon. But in a separate interview with Bloomberg, the Boston Fed chief said a Fed small business program may still be one to two weeks away.

Other effects of the crisis, he said, may prove persistent, with housing and office building prices likely to fall — and in the case of commercial real estate perhaps remaining depressed if people continue to work from home.

“For both homes and apartments as well as office properties we are likely to see softening of prices in some markets and maybe a fairly significant softening over time,” Rosengren said. “When we come back the question is whether we need the same amount of office space because we found work at home may be more effective.”

Rosengren, who in recent years has warned that historically low Fed interest rates encouraged unhealthy levels of borrowing, also said that overhang of debt could worsen the recession to come and slow the recovery from it.

“When you have a black sawn event like this individuals and firms that are very levered have much more difficulty in making sure they can manage through,” Rosengren said, adding he expected banks will see more commercial real estate borrowers fall behind on payments.

“Today, we’re witnessing the pandemic’s stark effects on public health. Meanwhile, the necessary response – social

distancing – has stilled our strong economy, disrupting countless lives and livelihoods,” Rosengren said in prepared remarks for the session.

(Reporting by Jonnelle Marte; Editing by Chizu Nomiyama and Alistair Bell)