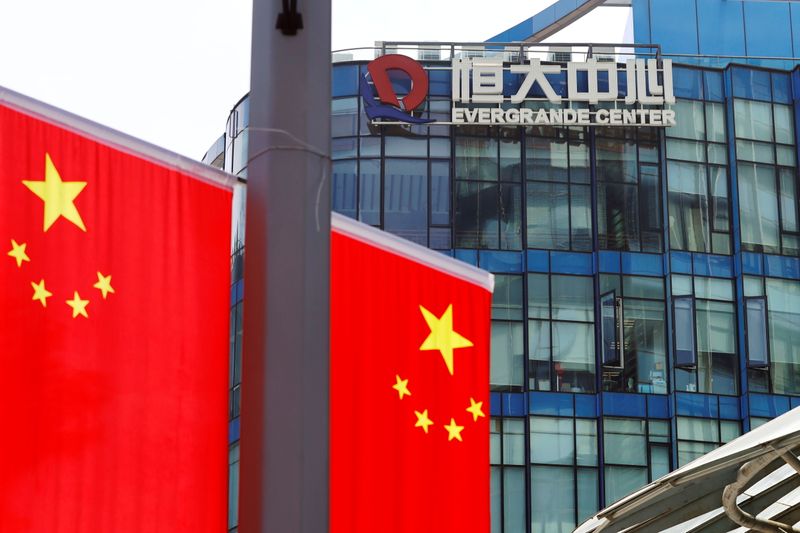

(Reuters) – Sharp falls in the stocks and bonds of China Evergrande Group have raised the spectre of losses for global asset managers with exposure to the embattled property developer.

The below graphics show the exposure of asset managers to the Chinese firms stocks and bonds and how they have performed.

On the equities side, various Vanguard funds held a combined $40 million or so worth of shares as of August, Refinitiv Eikon, data showed, while BlackRock held at least $13 million across its iShare MSCI emerging market ETFs.

Graphic: Funds with biggest shareholding in China Evergrande Group: https://fingfx.thomsonreuters.com/gfx/mkt/byprjlxlkpe/Funds%20with%20biggest%20shareholding%20in%20China%20Evergrande%20Group.jpg

Evergrande bondholders also include some of the world’s biggest asset managers, according to the latest data published by Morningstar Direct on holdings of U.S. and cross border funds, as well as Asian bond funds.

The debt is held by funds run by asset managers such as UBS, Fidelity, PIMCO as well as emerging markets focused asset manager Ashmore Group, the data showed.

Graphic: Asian debt funds’ holdings in China Evergrande bonds: https://fingfx.thomsonreuters.com/gfx/mkt/movankdnopa/Funds%20with%20biggest%20exposure%20to%20China%20Evergrande%20Grpup’s%20bonds.jpg

Graphic: EM debt funds’ holdings of Evergrande bonds: https://fingfx.thomsonreuters.com/gfx/mkt/zjpqkjdxgpx/EM%20debt%20funds’%20holdings%20of%20Evergrande%20bonds.jpg

Some of the funds had raised Evergrande exposure in July and August even as unease grew over its financial situation, Morningstar found.

Shares in Evergrande have recouped some recent losses after the firm announced on Wednesday it had struck a deal to settle interest payments on a domestic bond. It reassured retail investors on Thursday that they were a top priority.

On Monday, stocks ended the day more than 8% higher. However, the stock has plunged 83% this year, the fourth-biggest decline among Asia’s large and mid-cap companies, according to Refinitiv data.

Graphic: Performance of China Evergrande Group’s shares this year: https://fingfx.thomsonreuters.com/gfx/mkt/byprjlxkkpe/Performance%20of%20China%20Evergrande%20Group’s%20shares%20this%20year.jpg

Evergrande missed a $83.5 million coupon payment deadline on a dollar bond last week and its silence on the matter has left global investors wondering if they will have to swallow large losses when a 30-day grace period ends.

Yield on that bond maturing March 2022 hit a record high of 636% on Wednesday, compared to 13.7% at the start of the year. It was trading at 570% on Monday.

Graphic: Change in China Evergrande Group’s bond yields this year: https://fingfx.thomsonreuters.com/gfx/mkt/akvezqnjzpr/Change%20in%20China%20Evergrande%20Group’s%20bond%20yields%20this%20year.jpg

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Nick Zieminski)