By Jan Strupczewski and Andrea Shalal

BRUSSELS/WASHINGTON (Reuters) -World finance chiefs will agree on Wednesday to boost reserves at the International Monetary Fund by $650 billion and extend a freeze on developing countries’ debt servicing to help them deal with the coronavirus pandemic, a draft statement said.

The draft, seen by Reuters, also showed finance ministers and central bank governors of the world’s 20 biggest economies (G20) reviving a pledge to fight trade protectionism – a reference dropped since March 2017 at the insistence of the administration of former U.S. president Donald Trump.

It also sharpened language on tackling climate change, a topic watered down in G20 statements during the Trump era.

“We will further step up our support to vulnerable countries as they address the challenges associated with the COVID-19 pandemic,” said the draft, to be endorsed at a virtual G20 finance leaders’ meeting on Wednesday.

“We call on the IMF to make a comprehensive proposal for a new Special Drawing Rights (SDR) general allocation of USD 650 billion to meet the long-term global need to supplement reserve assets,” said the draft.

Expanding the IMF’s reserves, or SDRs, would boost liquidity for all members, without adding to the debt burden of the 30-some countries already in or facing debt distress, finance officials and economists said.

The draft showed the G20 also agreed to a final extension to the end of 2021 of the Debt Service Suspension Initiative, meant to free cash in developing countries to fight COVID-19.

Extending the freeze on debt service payments by the poorest countries could provide billions of dollars for them to spend on vaccines and stimulus, World Bank head David Malpass told reporters on Monday.

“We reiterate our call on the private sector, when requested by eligible countries, to take part in the DSSI on comparable terms,” the draft communique said.

FAIRER, WIDER ACCESS TO VACCINES

More than 250 faith groups and non-profit organizations urged G20 leaders, the White House and the IMF to go beyond a moratorium to actually cancel debt and expand debt relief for developing countries, in a letter to be delivered on Wednesday.

The draft said debt assessments would be made case by case.

The IMF on Tuesday raised its 2021 global growth forecast to 6%. However, pointing to a dramatic divergence between the outlook for the United States and much of the rest of the world, it said the pandemic could reverse years of progress in reducing poverty.

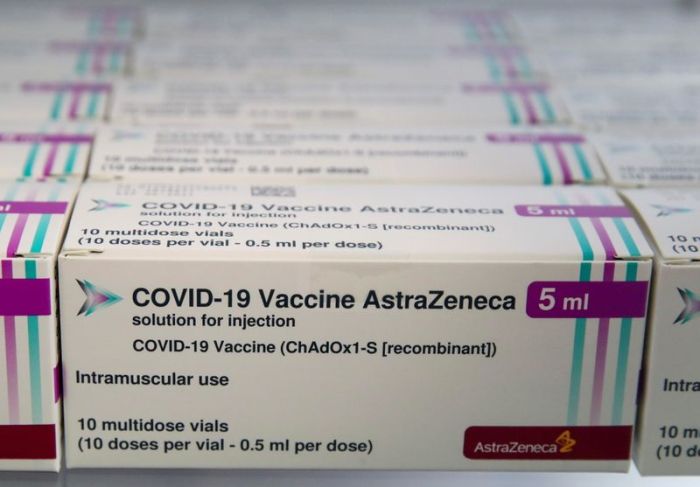

The draft said the G20 also backed equitable access to COVID-19 vaccines and encouraged efforts to rapidly step up the production and distribution of shots, without which there would be no stable and lasting recovery.

“In this regard, we recognize the role of COVID-19 immunization as a global public good,” the draft said.

The G20 gathering will also give U.S. Treasury Secretary Janet Yellen a chance to press for a global minimum tax on corporate profits.

The draft showed the G20 expected a deal by the middle of the year on where large multinational companies, including digital giants like Google, Amazon or Facebook, should be taxed and at what minimum rate.

At Yellen’s wish, the G20 draft removed a reference in the communique to stable exchange rates first inserted by the Trump administration, reverting to phrasing that emphasizes the importance of underlying fundamentals.

“We … note that exchange rate flexibility can facilitate the adjustment of our economies,” the draft also added.

“…We will refrain from competitive devaluations and will not target our exchange rates for competitive purposes.”

Yellen had told U.S. senators during her confirmation hearing that the value of the dollar should be determined by markets, a break from Trump’s desire for a weaker currency.

(Writing by Jan Strupczewski; Editing by Mark John and John Stonestreet)