WASHINGTON (Reuters) -The odds-on Democratic victory in two U.S. Senate races on Tuesday could open the door to the more robust government spending response economists and others have argued is needed to get the country through the pandemic with as little long-term economic damage to companies and households as possible.

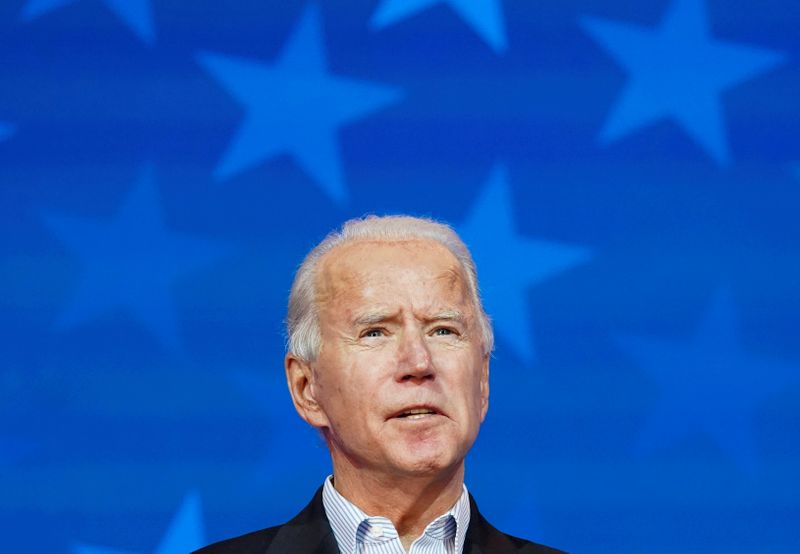

While results in the Georgia contests are not yet official, rising U.S. bond yields on Wednesday showed investors were already pricing in Democratic control of not just the White House, when President-elect Joe Biden takes office in two weeks, but both chambers of the U.S. Congress.

It would be the first unified control by Democrats since President Barack Obama took office in January 2009, and in short order could allow the new administration to move forward with a targeted spending bill to help local governments add hospital capacity, pay for frontline workers, reopen schools and administer vaccinations, according to Biden aides and congressional allies.

New York Senator Charles Schumer, the likely Senate majority leader if the current results from the U.S. state of Georgia hold up, said a top priority will be raising to $2,000 from $600 the relief payments Congress approved late last year for many individuals.

“We have an opportunity to really move something that can revive the economy and put a stop to the virus,” said William Spriggs, the chief economist with the AFL-CIO who served in the Labor Department under President Obama.

Between aid for local government and possible further help for families and businesses, economists have estimated that perhaps another trillion dollars of support could hit the economy in the first part of the year, a boost to spending and a downpayment on filling the gap in U.S. output caused by the worst economic downturn in decades.

“We assume an additional $1 trillion of stimulus in the next few months…This will close the output gap roughly 4-6 quarters” faster than expected, analysts from Jefferies wrote. That could shift the economy’s fortunes enough for the Fed to start raising interest rates by early 2023 instead of in the following year, as currently anticipated.

Vote counts showed Georgia Democratic candidates Raphael Warnock and Jon Ossoff leading their Republican rivals, with outstanding ballots concentrated in heavily Democratic areas.

The Democratic majorities would be slim in both chambers of Congress – and in the Senate would rely on Vice President Kamala Harris’ role as the tie-breaking vote among what would be 50 Democrat or Democrat-allied members and 50 Republicans.

SEA CHANGE

Still, the Georgia results represent a sea change in the dynamics faced by the Biden administration as it takes charge of an arguably ugly economic and health crisis.

Record numbers of people are collecting unemployment insurance, and job growth may be slowing. Data from payroll processor ADP on Wednesday showed employers cut jobs last month for the first time since April, and many economists expect that to be confirmed when the government’s more comprehensive employment report is released on Friday.

Whole industries remain partly sidelined by the pandemic, and an average of more than 2,500 have been dying daily from the disease.

Yet there may be opportunity as well, foremost from the vaccine, but also from the changed political climate and from what is likely to be a cooperative U.S. Federal Reserve.

Instead of Republicans setting the Senate’s agenda, chairing its committees, and potentially stalling Biden’s agenda and cabinet or court nominations, a sympathetic Congress may be ready to prime the pump, with Democrat’s taking over as committee chairs and replacing the current majority leader, Kentucky Republican Senator Mitch McConnell.

Unlike the initial years of President Donald Trump’s administration, when the Fed felt it needed to counter Trump’s rising government spending and tax cuts with higher interest rates, the central bank has since changed its approach and will likely leave its crisis-era low interest rates and monthly bondbuying in place to try to bring down unemployment as low as possible.

Analysts from Evercore ISI said they expected perhaps $2 trillion in new proposals now, divided between legislation providing immediate coronavirus relief “followed by a more medium-range investment bill emphasizing infrastructure and greening” the economy.

Far from becoming concerned about possible inflation as government spending grows, a classic worry for central bankers, “the Fed will welcome greater prospects of fiscal support.”

Congress recently extended some federal benefits in a $900 billion spending bill approved in late December meant to provide a lifeline to the unemployed and ailing small businesses for the next few months.

The impact of the vaccine may not be broadly felt, however, until the second half of this year, and economists from both parties have said that further government help will likely be needed before then to ensure the United States is poised to take advantage of a fuller economic reopening.

One worry about a stingier approach is that, even as the vaccine’s impact is felt, people would be too financially impaired to spend, and businesses either too strapped to hire and invest or failed altogether.

At an American Economic Association panel this week, Austan Goolsbee, a University of Chicago Booth School of Business professor and a senior economic advisor to President Obama, said the U.S. economy needs fiscal support at a pace of about $1 trillion every six months until the virus is controlled. Kevin Hassett, a former top economic advisor to President Donald Trump, said he agreed with that “run rate.”

(Reporting by Howard Schneider; Additional reporting by Ann Saphir, Jonnelle Marte and Trevor Hunnicutt; Editing by Andrea Ricci)