(Reuters) -London-listed Petropavlovsk will miss a loan payment due on Friday after Britain froze the assets of its main lender Gazprombank in its latest set of sanctions following Russia’s invasion of Ukraine.

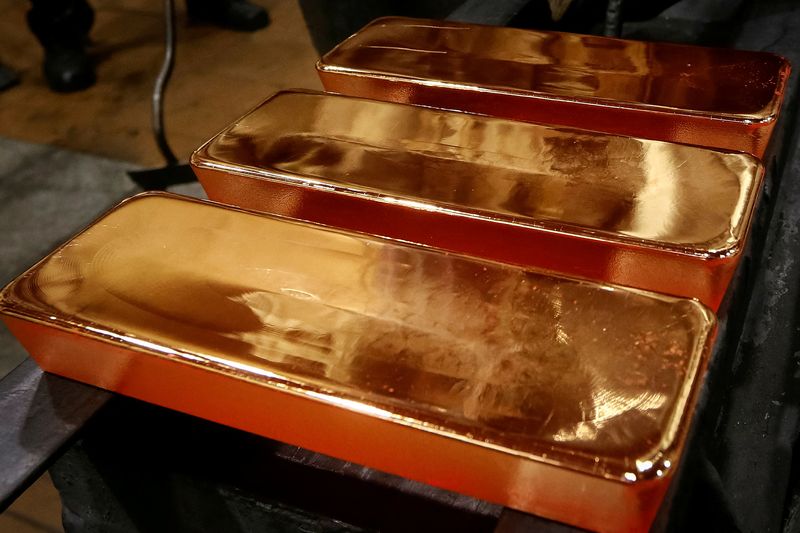

Russia-focused Petropavlovsk has agreements, including for loans and bullion sales with Gazprombank, which make it difficult for the miner to sell its gold and refinance loans now Britain has frozen assets the bank’s assets.

The company is restricted from paying $560,000 in interest due on Friday on its $200 million term loan with Gazprombank, Petropavlovsk said.

Although Petropavlovsk itself has not been named in any of the Western sanctions to-date, it will be thrown out of FTSE indexes this month after many brokers refused to trade their shares in the miner and in others with Russian links.

Petropavlovsk shares sank more than 30% on Friday, adding to the over 85% loss in stock value since Russia’s invasion of Ukraine began on Feb. 24. Moscow has called its actions in its neighbouring country a “special military operation”.

A Petropavlovsk spokesperson, who declined to comment beyond the company’s statement, said the miner’s debt portfolio consists of facilities with Gazprombank, a convertible bond and a eurobond, with no other bank loans at present.

Western leaders have tightened sanctions on Russia as the attack on Ukraine entered its second month. That has had a knock on effect on companies with no apparent direct ties with sanctioned people or companies and hurt investor sentiment.

Petropavlovsk was founded by British businessman Peter Hambro and Russia’s Pavel Maslovskiy in the 1990s. Its top investor is Russian businessman Sergey Sudarikov, who through his REGION brand of businesses disclosed a stake of just over 29% in the miner earlier this month, regulatory filings show.

REGION is also a shareholder in the sanctioned Credit Bank of Moscow, according to Refinitiv Eikon data.

Peel Hunt analysts in a note said the Gazprombank asset freeze also complicated Petropavlovsk’s ability to refinance its bonds due in November.

(Reporting by Pushkala Aripaka in Bengaluru; Editing by Sherry Jacob-Phillips, Sriraj Kalluvila and Barbara Lewis)