NEW YORK (Reuters) – Investors who met news of likely gridlock in Washington with a large-scale unwind of bets on a Democratic sweep weighed prospects for big stimulus measures while cheering fading expectations of higher taxes and new regulations.

Regardless of whether Democrat Joe Biden or Republican Donald Trump wins the presidency, some investors on Wednesday welcomed the prospect that either candidate would likely face some opposition in Congress that would be a barrier to sweeping legislative changes.

“The market likes the fact that we have a gridlock,” said Gary Bradshaw, senior vice president at Hodges Capital Management in Dallas. “We are not likely to see big tax increases, and not a lot of regulation.”

Despite predictions ahead of the election that not having an early clear result could derail stocks, equities soared as the prospect of gridlock provided some solace and calm.

Markets saw tempering of so-called “reflation” trades that had predicted a strong Democratic score in presidential and U.S. Senate races would lead to a bigger stimulus and higher inflation, as well as some safe-haven buying on caution the election is so close.

“There is no blue wave,” said Robert Sears, chief investment officer at Capital Generation Partners. “The chance of a lot of fiscal spending … that scenario is out of the window now because it looks like Republicans are going to keep the Senate.”

U.S. Treasuries gained and the dollar shuffled between gains and losses as investors discounted chances for a massive stimulus package to help the U.S. economy recover from the coronavirus pandemic, which has killed more than 230,000 Americans.

A major bet on a Democratic “blue wave” sweep was being unwound, as traders pulled out of bearish bets that long-dated Treasury yields would rise.

Major U.S. stock indexes ended higher, led by the tech-heavy Nasdaq Composite up nearly 4%, reflecting bets on receding chances of a Democratic takeover of Washington that could usher in higher capital gains taxes or tougher antitrust measures, as well the prospect of lower interest rates.

The election results were more “down the middle,” said Matt Peron, director of research at Janus Henderson Investors in Denver, “meaning no clear mandate on either side, so there will have to be a lot of compromise.”

“I think the market sees that as a removal of uncertainty and the market likes that,” Peron said.

Healthcare stocks also surged amid relief that regulatory pressure that could have swept through the sector in a Democratic sweep would not materialize. Sectors seen benefiting from a major stimulus package, such as financials, weakened.

Asian stocks firmed on Thursday, while trading in U.S. stock futures was more subdued as it resumed on Wednesday night, with S&P 500 futures moving modestly higher, and Nasdaq 100 futures outperforming.

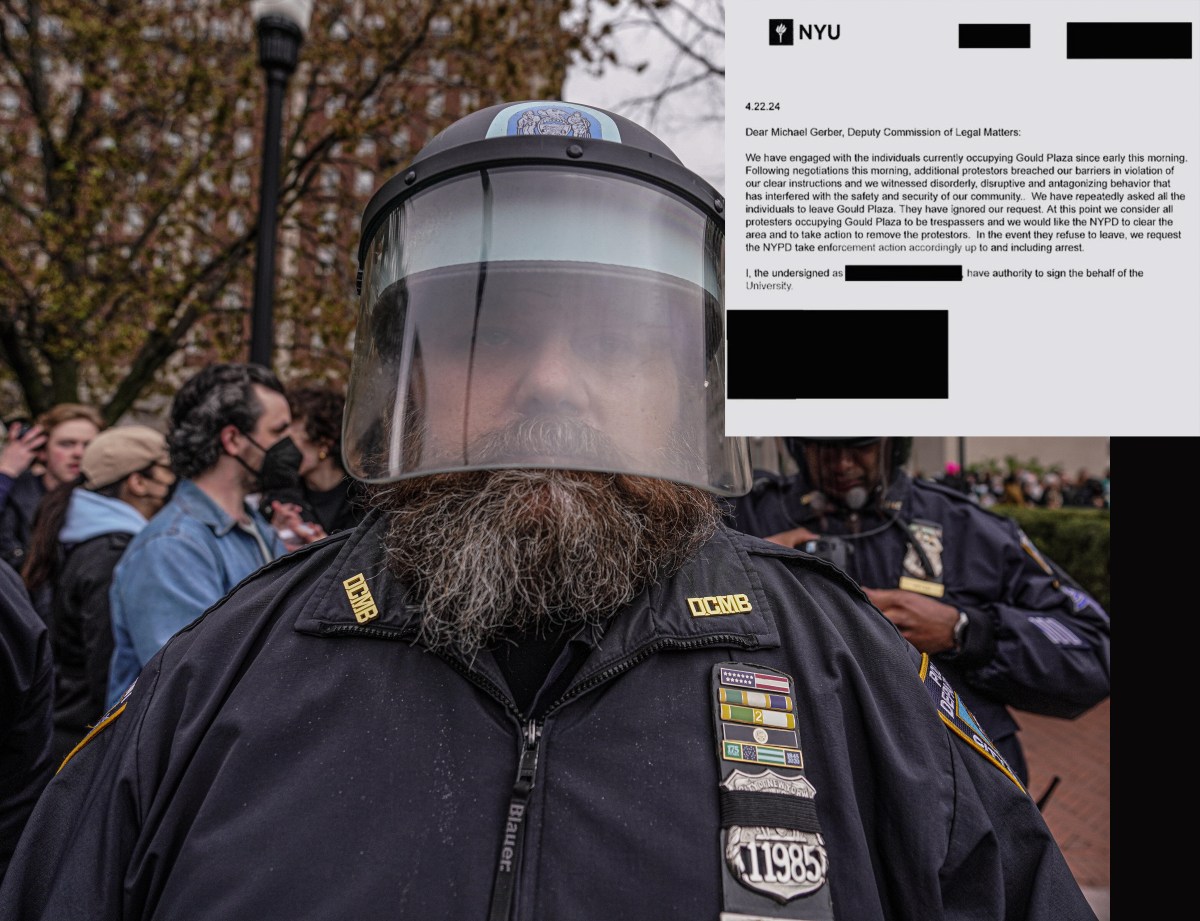

BIDEN IN FRONT, TRUMP EYES COURTS

Biden said he was headed toward a victory after claiming the pivotal Midwestern states of Wisconsin and Michigan. Trump opened a multi-pronged attack on vote counts by pursuing lawsuits and a recount.

Reflecting the uncertainty, betting markets swung violently on the presidential vote. As of Wednesday evening, Biden was holding on to his position as a clear favorite to win the U.S. presidential election in online betting markets, a shift from the previous night.

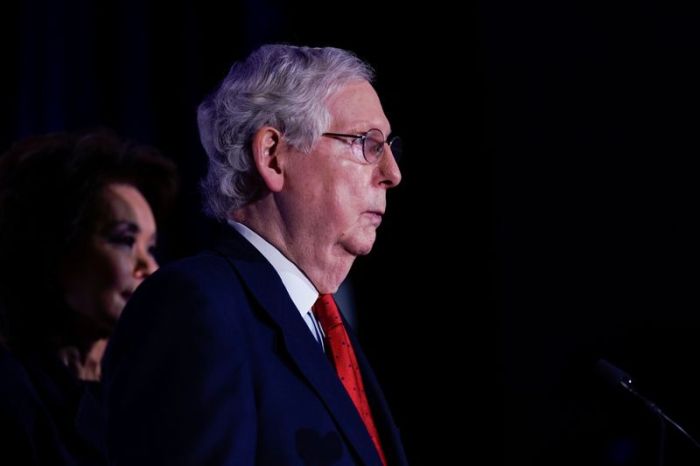

But Republicans appeared poised to retain control of the U.S. Senate, after Senator Susan Collins won re-election in Maine and other Republican incumbents led Democrats in a handful of undecided races.

Since the 2016 election of Trump, who ushered in corporate tax cuts that supported equities but also imposed trade tariffs that led to volatility, the benchmark S&P 500 stock index has gained over 60% and hit new highs.

Investors remain most worried about the presidential race being too close to call or contested for a prolonged period.

“Markets can live with either candidate,” said Francois Savary, chief investment officer at Swiss wealth manager Prime Partners. “The scenario they don’t want are legal problems over the outcome and significant political unrest.”

Graphic – World stocks market cap rise over last four years: https://fingfx.thomsonreuters.com/gfx/mkt/bdwpkjmoovm/Pasted%20image%201604323646730.png

(Additional reporting and editing by Tom Arnold, Elizabeth Howcroft, Ritvik Carvalho and Dhara Ranasinghe in London, Susan Mathew in Bengaluru, Ira Iosebashvili, Rodrigo Campos, Gui Qing Koh and Megan Davies in New York, Noel Randewich in San Francisco, Tom Westbrook in Singapore, Maiya Keidan in Toronto; Editing by Mike Dolan, Lincoln Feast, Emelia Sithole-Matarise, Megan Davies, David Evans and Jonathan Oatis)