By Tetsushi Kajimoto

TOKYO (Reuters) -Japanese policymakers warned on Tuesday against any rapid moves in the foreign exchange market, underscoring the importance of stability as authorities kept a wary watch on the yen after it slumped to six-year lows against the dollar.

Prime Minister Fumio Kishida told parliament’s lower house that stability in currencies is important and any rapid moves are undesirable, keeping up warnings against the yen’s depreciation that boosts the cost of living.

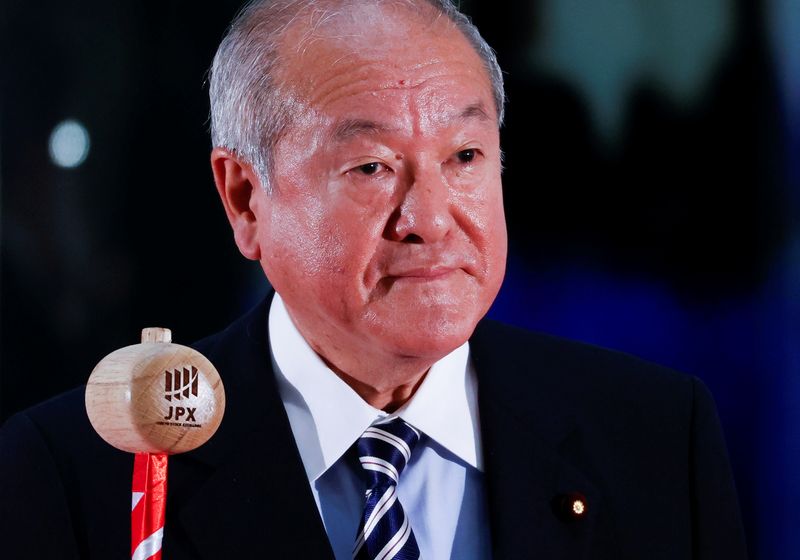

Finance Minister Shunichi Suzuki echoed the concern, adding that Japan will communicate closely with the United States and other countries to respond to currency moves appropriately, signalling the prospect of joint action, although investors saw no imminent chance of currency intervention.

The Japanese currency broke beyond 125 yen on Monday due to widening interest rate differentials between Japan and the United States, as bets the U.S. Federal Reserve will accelerate tightening contrasted with the Bank of Japan’s commitment to keep in place its ultra-easy monetary settings.

“The government is closely watching currency moves, including the recent yen weakening, and its impact on the Japanese economy with a sense of urgency,” Suzuki said.

He noted the Group of Seven (G7) advanced economies have agreed to have exchange rates set by markets, to closely consult on action in the currency market and have acknowledged that excess volatility and disorderly moves can have adverse effects on economic and financial stability.

“Based on the G7 agreement, we’ll respond appropriately while closely communicating with currency authorities of the United States and others,” Suzuki said.

Despite the comments, investors see little chance of immediate action by Japanese currency authorities, especially as long as policymakers maintain that the current yen weakness is good for Japan, said Daisuke Karakama, chief market economist at Mizuho Bank.

Chief Cabinet Secretary Hirokazu Matsuno has occasionally attempted to talk up a weak yen, while Bank of Japan Governor Haruhiko Kuroda hasn’t shown any serious concerns about the current downturn in the currency.

A weak yen tends to boost exporters’ earnings, while lifting the cost of imports for the resource-deficient Japanese economy, squeezing household incomes and importers’ bottom line.

Over the past decade or so, the benefits to exporters from a weak yen have lessened as many Japanese manufacturers have moved overseas.

“Japanese authorities are not yet escalating warning against the weak yen,” Karakama said, adding that the currency’s further descent beyond 130 yen to the dollar towards 140 could be a trigger.

“If that becomes political issues by further fuelling oil and other price hikes, policymakers may be prompted into action.”

(Reporting by Tetsushi Kajimoto; additional reporting by Kantaro KomiyaEditing by Chang-Ran Kim, Shri Navaratnam and Raju Gopalakrishnan)