The most well-intentioned holiday gifts can fall flat. Ask Arlene Claudio of San Diego, who once received a 60-day gym membership from a health-conscious aunt.

“I opened it in front of my family. Everyone was quiet. I felt red,” says Claudio, 36.

That gift went unused. If you want to avoid the same fate for your presents, consider giving money. You have many options beyond greenbacks, but each comes with its pro and cons.

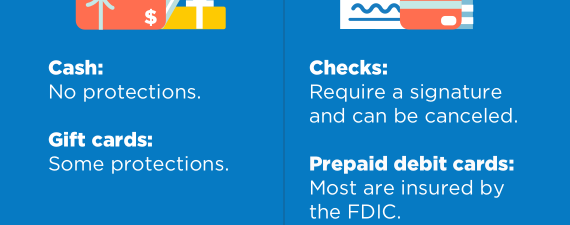

1. Cash

Crisp green bills make a great gift for everyone from your hairdresser to your niece. Only give an amount that you’re willing to lose, because cash is unprotected. Consider a limit of $500, the minimum emergency savings most people should have in an account. Look into safer money-giving options if you’re feeling extra generous this season. Pros

– Ideal for any age. Cons

– Cash doesn’t have protections from loss or theft.

“I would prefer cash just because I am able to choose what I spend it on. Many times I might need money to buy books or school supplies, or even a quick snack if I’m running late,” says Celeste Renteria, a student at University of California, Santa Cruz. “For many of those things, it would be hard to use a gift card when I’m on campus.” » MORE:5 frugality pros help you rein in holiday spending

2. Gift cards

Gift cards are as popular as ever, and those to department stores and restaurants top the list, according to the National Retail Federation.

Still, many go unredeemed. The advisory firm CEB Towergroup estimates that $973 million on gift cards went unused in 2015.

Pros

– Some stores allow savings of $20 on select cards purchased in bulk. Cons

– They are not federally insured. » MORE:You got a gift card you don’t want. Now what?

3. Prepaid debit cards

Prepaid debit cards are an alternative to traditional banking for people without checking accounts. With this option, you can give at the holidays and other special occasions like birthdays by adding money to the card. Carefully read the terms of agreement. Some cards come with many fees, but low-fee options make a better gift. Depending on the issuer, the cardholder may be able to dispute errors and unauthorized transactions. On Oct. 1, 2017, new federal rules will allow cardholders to dispute any fraudulent charges or mistakes. Pros

– Most cards are federally insured. Cons

– Recipients must be 18 or older, unless the child is on a parent’s card. » MORE:Prepaid debit cards: What you should know

4. Checks

Checks are a safer option than cash. And, they can still put a smile on someone’s face when they are tucked in a card or a holiday stocking.

Pros

– Ideal for any age. Cons

– Checks take a few business days to clear. 5. A child’s first savings account

A low-fee savings account can help a child save for college or other goals. Usually an adult — you or a parent — is required to be a joint owner of the account, so consult the parents if you want to go this route. Pros

– It teaches children to save. Cons

– Some accounts may have age requirements for the child. 6. Certificates of deposit

CDs usually function like a joint bank account, so you’ll need to loop in the recipient or a parent for this gift. They are a good fit for larger amounts of money that can help the recipient save for a goal he or she wants to reach within five years. For example, you can help a friend or loved one save for a home or a car. Make sure you get the best CD rates. Pros

– CDs can offer a higher interest rate than a savings account. Cons

– They can affecta child’s financial aid eligibility. You have many options for giving money. The best choice represents the recipient’s interests and yours.

“I can laugh about it now,” says Claudio of her gym gift. “A few years after, I heard that my cousin was actually rigging the secret Santa so that none of our ‘overweight’ family members got [the aunt].” Think carefully about your money gift so you delight your recipients — and maintain your gift-giving rep.

Melissa Lambarena is a staff writer at NerdWallet, a personal finance website. Email: mlambarena@nerdwallet.com. Twitter: @LissaLambarena. The article 6 Ways to Give Money as Holiday Gifts originally appeared on NerdWallet.

– It’s accepted everywhere.

– They can’t expire within five years of the purchase date (may vary by state).

– Not all issuers allow the recovery of funds for a lost or stolen gift card.

– Inactivity fees may be charged if the card isn’t used in a year.

– Some cards allow money transfers from a prepaid card or bank account for future gifts.

– Many cards offer purchase protections, but they’re inconsistent.

– Excessive fees can eat away at money on the card.

– Lost checks can be canceled for a fee.

– Your bank account and routing number are vulnerable to scams when checks fall into the wrong hands.

– You can make ongoing contributions.

– You can give up to $14,000 annually to an individual and still avoid gift taxes.

– Funds could affect the child’s college financial aid eligibility, according to Nessa Feddis, senior vice president of the American Bankers Association.

– CDs don’t need monitoring like a bank account.

– You may pay penalties if youwithdraw funds early.

6 Ways to Give Money as Holiday Gifts