By Huw Jones

LONDON (Reuters) – Global regulators have proposed a raft of measures to curb contagion risks from the world’s $76 trillion asset management sector, though stopping short of imposing tougher capital requirements. As banks shrink balance sheets in the face of tougher capital rules since the financial crisis, asset managers have filled the gap by growing from $50 trillion in 2004 to $76 trillion in 2014, or 40 percent of assets in the global financial system. The Financial Stability Board (FSB), which coordinates regulation for the Group of 20 Economies (G20), said a core concern was the promise open-ended funds make to give investors their money back straight away, even in stressed markets when liquidity is tight. Asset managers have also moved into “shadow-banking” or market financing activities like lending securities or offering loans to companies as traditional banks retreat.

The FSB’s 14 proposed measures, put out for public consultation, are to be implemented over two years from the end of 2017.

They call on national regulators to gather more data on the sector, monitor leverage, and ensure that funds have the right set of tools to use in stressed markets, such as slapping fees and “gates” and other restrictions to discourage redemptions. Stress-testing, now common in banking, should also be applied to funds.

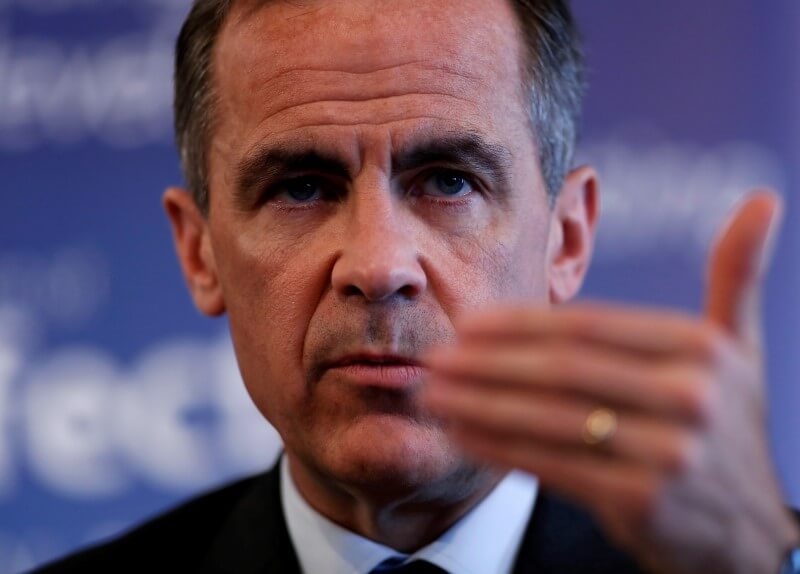

“Given its increased importance, a resilient asset management sector is vital to finance strong, sustainable and balanced growth,” said Mark Carney, the Bank of England governor, who chairs the FSB. The proposals mark a second stab by the FSB at regulating asset managers.

A first attempt to single out which funds are globally systemically important and needing tougher rules because of their size was derailed by IOSCO, the global securities market regulators body, resulting in a switch of focus to the sector’s activities. The FSB listed the 10 largest asset managers, ranging from Deutsche Bank, Capital Group and Axa Group with assets of more than a trillion dollars, to Vanguard and BlackRock with assets of over $4 trillion. Some IOSCO members and asset managers say their size does not pose a systemic risk to financial stability or needs tough measures like higher capital requirements.

Funds already have decades of experience in successfully managing the areas the FSB now identifies as vulnerabilities, said the Investment Company Institute, a global funds trade body whose members manage $18 trillion in assets. “In particular, we emphasize again that there is no empirical basis for the FSB to pursue the designation of regulated funds or their managers as global systemically important financial institutions,” ICI President Paul Schott Stevens said. The FSB said that while funds, with the exception of money market funds, have not created financial stability concerns, it was still necessary to understand and address what risks the wider sector could pose. The focus on funds’ activities sharpened after “taper tantrums” or big and rapid falls in U.S. bond prices on the prospect of rate rises.

Such moves make it harder for bond funds to honor redemption commitments to investors, especially as liquidity in markets has already thinned in recent years.

IOSCO will begin implementing the rules from the end of 2017 once they have been finalised by the end of this year.

(Reporting by Huw Jones; Editing by Susan Fenton)

G20 regulators aim to rein in asset managers with new rules

By Huw Jones