Some people say “cashless” is the way of future. But not in Philadelphia.

Mayor Jim Kenney signed a bill passed by Philadelphia City Council to ban stores from refusing to accept cash, his office said Thursday. Violations could lead to fines of $2,000.

“With a 26-percent poverty rate in Philadelphia, the Mayor believes in equal opportunity for all,” Kenney’s spokesman Mike Dunn said via email. “Until we can resolve the hurdles facing the unbanked, we need to remove any obstacles that could prevent them from enjoying all amenities of this city – amenities that are readily available to those fortunate enough to have a debit or credit card.”

Whether intentionally or not, cashless businesses are effectively discriminatory against low-income residents who do not have credit or debit cards, argued City Councilman Bill Greenlee, who introduced the legislation in October.

“Some places are basically saying ‘We don’t need your business or want your business here,'” Greenlee previously explained to Metro. “Even if it’s not intentional, it’s discrimination, because the cashless stores basically exclude a segment of the lower-income, minority, immigrant population.”

According to a 2018 survey by the Pew Research Center, 34 percent of African Americans, 17 percent of Hispanic people, and 29 percent of people earning less than $30,000 a year currently rely on cash for all their transactions.

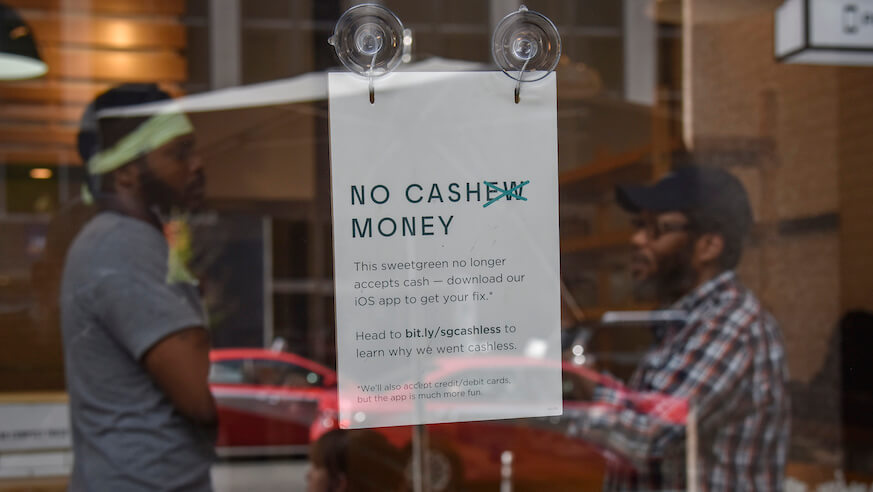

The bill passed Council 12-4 on Feb. 14. It will affect chains like Sweetgreen and Blue Stone which do not accept cash currently. Neither chain immediately responded to requests for comment.

Greenlee said he was “happy” after the bill was passed into law, and expressed some skepticism of anyone claiming that being required to take cash will be a hardship for some businesses.

“This isn’t a new phenomenon of accepting cash,” Greenlee said. “When Ben Franklin was walking around, they did it. I don’t see it as that onerous on businesses.”

Kenney signed the bill despite reports that the bill might prompt mega-retailer Amazon to reconsider its plans to open one of 3,000 planned Amazon Go retail stores in Philadelphia; however, the bill was amended to allow businesses to not use cash if they are paid through a membership model, Greenlee said.

“With all due respect to Amazon or whoever, they can’t dictate what we do, and say ‘We won’t come unless…’ No. We’ll work with you, but ultimatums won’t work,” Greenlee said. “I know they [Amazon] have some issues with it but we think they’ll be alright.”

Dunn said Kenney had “continued concerns about how this legislation might impact innovation in our retail sector,” and “will continue to monitor this” as the bill is rolled out.

But a bigger issue for Philadelphia, Kenney’s office stressed, is helping unbanked and low-income residents get savings accounts and credit cards so they can start earning interest and enjoying financial stability.

“We need to ensure all residents have full access to banking services that are key to improving their financial health,” Dunn said. “We are working on finding ways to do that, such as with initiatives like our new Municipal ID program.”

The cashless ban will take effect July 1.