BEIJING (Reuters) – Earnings for China’s industrial firms in June rose at the fastest pace in three months in the latest sign economic momentum in the country remains solid, though analysts expect growth to slow later this year as tighter policies begin to bite.

Profits surged 19.1 percent in June from a year earlier to 727.78 billion yuan ($107.83 billion), the National Bureau of Statistics (NBS) said on Thursday, accelerating from May even as rising borrowing costs have raised concerns about pressure on margins.

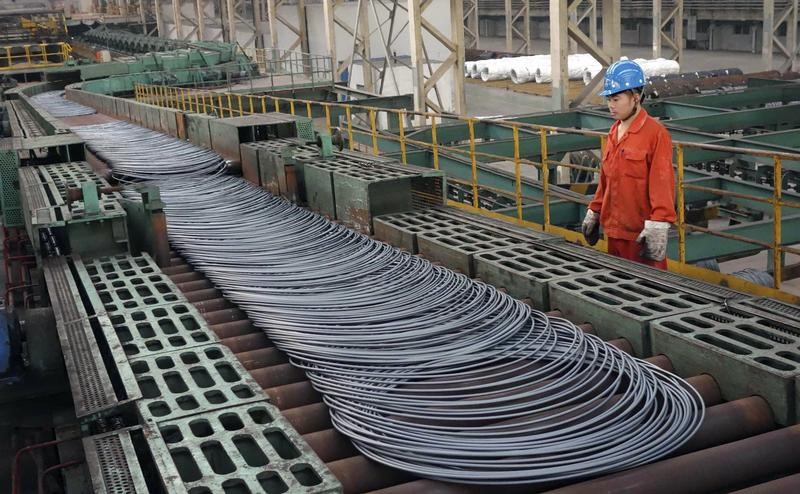

Statistics bureau official He Ping said in a statement that accelerated profits growth in steel, auto and electronics sectors helped to boost overall earnings.

A year-long construction boom in China has lifted earnings for both domestic companies like oil refiner PetroChina to multinational construction equipment maker Caterpillar Inc.

Moreover, solid global demand for Chinese goods have helped underpin growth as authorities tighten financial conditions in an attempt to tackle debt risks and reduce the world’s second-largest economy’s dependence on years of cheap credit.

“At this stage, companies are still doing well because their sales are still pretty good; they haven’t felt the liquidity issue,” said Nomura’s chief China economist Yang Zhao in Hong Kong.

For the first half of the year, the firms notched up profits of 3.63 trillion yuan, a 22.0 percent jump from the same period of last year and just a touch slower from the 22.7 percent annual growth in the January-May period.

The robust industrial earnings in June was in part driven by continued appetite for iron ore and other commodities, whose prices have recovered modestly after taking a hit since March.

Chinese policymakers have leaned on property investment and infrastructure spending, including their plan to build a modern “Silk Road” trading route, helping fuel a building boom that has boosted demand and prices for materials from steel to cement.

PRESSURE ON MARGINS, GROWTH?

Analysts expect economic growth to moderate in the year ahead after a solid first half, pressured by a flurry of regulatory measures launched early this year to tackle financial risks from a rapid build-up in debt and defuse a property market bubble.

The measures have raised borrowing rates, a headwind for businesses, particularly those struggling to reduce their debt servicing costs.

Indeed, NBS’s He said “rising financing costs for companies” needed to be monitored closely – a point emphasized by Nomura’s Zhao.

“If demand, particularly fixed asset investment demand, slows down due to a cooling property market…then the tightening liquidity will be more felt by companies”, said Zhao.

Industrial companies’ liabilities rose 6.4 percent year-on-year as of end-June, the statistics bureau said, versus 6.5 percent year-on-year through May.

Profits at China’s state-owned firms were up 45.8 percent at 805.5 billion yuan in January-June, compared with a 53.3 percent rise in the first five months.

China’s economy grew a faster-than-expected 6.9 percent in the second quarter, matching the first quarter’s pace, thanks to solid exports, industrial production and consumption.

The relatively solid economic growth is no doubt welcome news for President Xi Jinping ahead the major political leadership reshuffle in autumn, with authorities keen to ensure a smooth run-up to the meeting. Any sharp drop in industrial profits, a low-risk at this stage, will be a concern for policymakers as it risks rippling across the broader economy.

One sign of the growing pressure on margins is the peaking of factory gate inflation, suggesting profitability and new investment could taper off later this year.

“Looking ahead we still downside risks to profit growth, given the outlook for moderating producer price inflation, financial deleveraging and a cooling property market,” Zhao said.

(Reporting by Lusha Zhang and Ryan Woo; additional reporting by Elias Glenn; Editing by Shri Navaratnam)