By Hilary Russ

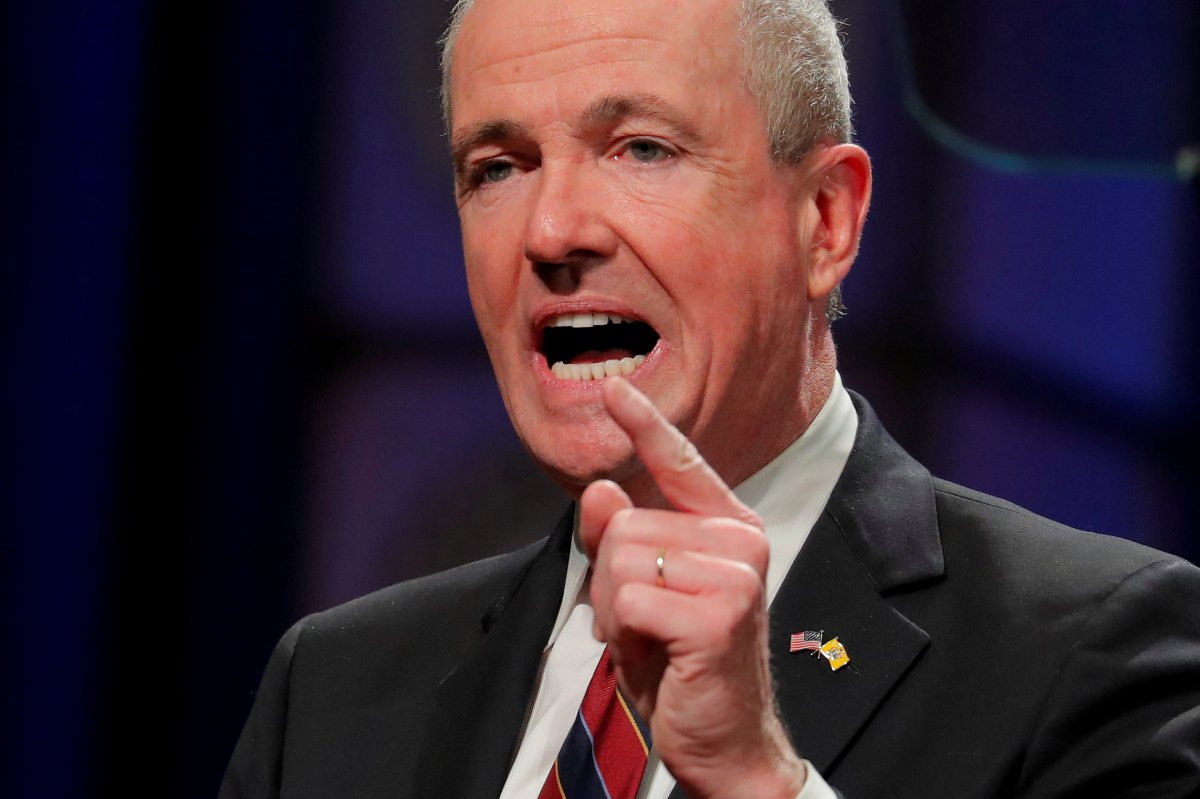

NEW YORK (Reuters) – New Jersey Governor Phil Murphy is expected to unveil tax hikes for businesses or millionaires and the green light for marijuana sales when he proposes his first state budget on Tuesday.

But the state is still mired in fiscal problems left over from Republican Chris Christie’s eight contentious years as governor, and the new Democrat governor’s planned tax rises may not be enough to pay for the bold initiatives he will need to distinguish his new governorship.

“The great cocktail party discussion in Trenton these days is – what’s the budget going to look like. And the response is, ugly,” said Ben Dworkin, founding director of the Institute for Public Policy & Citizenship at Rowan University in Glassboro.

Murphy’s campaign pledges included raising the minimum wage to $15 an hour, increasing school aid, making community college free and divesting state investments in hedge funds.

“This is a watershed moment in the state’s history,” said Brigid Harrison, political science professor at Montclair State University in Montclair. “The governor went into this making all kinds of promises … all of which cost money.”

Although Democrats run both houses of the state legislature, some lawmakers may blanch at higher state taxes, given that federal tax changes are expected to penalize residents of high-income, high-tax states including New Jersey.

Senate President Stephen Sweeney previously pushed a millionaire’s tax several times, but last month he called it “too much” and a “last resort” since the federal tax shift.

New Jersey’s other long-term problems still loom. The state has huge liabilities in its underfunded $76 billion public pension system, which was just 49 percent funded in fiscal 2016, according to the most recent data available.

Murphy’s proposal for fiscal year 2019, which begins July 1, will also have to cope without the one-shot revenue measures in the current budget.

Including the loss of revenues from Christie’s sales tax cut – part of his 2016 deal to offset higher gas taxes – total one-time revenues are about $1.4 billion, Moody’s Investors Service analyst Baye Larsen said.

Additionally, New Jersey, unlike most states, failed to replenish its now-empty rainy day fund after draining it in 2009 during the recession, according to The Pew Charitable Trusts.

Those pressures contributed to 11 credit downgrades from Wall Street rating agencies during Christie’s tenure. The state is rated ‘A-‘ with a stable outlook by S&P Global Ratings, the second lowest of all U.S. states after Illinois.

Lower scores mean New Jersey must pay higher interest rates to borrow, costing taxpayers more.

The state’s credit spread over top-rated muni debt is 78 basis points. That figure, which shows the gap between New Jersey bonds and triple-A rated bonds, widened from 28 basis points in January 2010 when Christie took office to 115 basis points in June 2017, according to Municipal Market Data, a Thomson Reuters unit.

(Reporting by Hilary Russ; Editing by Daniel Bases and Rosalba O’Brien)