NEW YORK (Reuters) – Oil prices fell for a third day on Tuesday, as Germany, France and other European states suspended the use of a major coronavirus vaccine, threatening the recovery of fuel demand.

Brent crude fell 49 cents to settle at $68.39 a barrel, while U.S. crude dropped 59 cents to end at $64.80 a barrel.

Earlier this month, Brent reached its highest since early 2020, while U.S. crude hit a 2018 high.

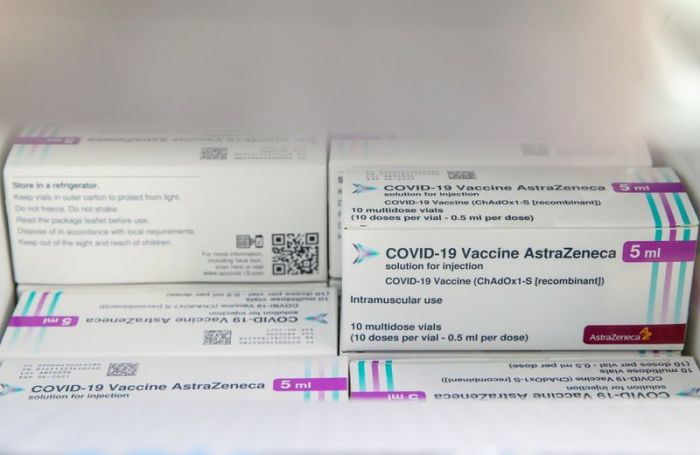

Germany, France and Italy said they would suspend use of the Oxford/AstraZeneca COVID-19 vaccine after reports about possible serious side effects, although the World Health Organization said there was no established link to the vaccine.

Europe’s medicines watchdog said the benefits of the AstraZeneca vaccine outweigh its risks. Investors are worried the slow pace of vaccinations in the European Union could hurt economic recovery and fuel demand.

“For oil demand to fully recover, a successful and rapid inoculation of the global population needs to take place,” said Bjornar Tonhaugen, Rystad Energy’s head of oil markets. “Before the recent setback, there was positivity that the campaigns under way were on the right track.”

The pandemic eviscerated demand for oil. Prices have recovered to levels seen before the global health crisis, but gains have been capped by slow progress of vaccine rollouts in many countries.

In the United States, crude inventories are rising as refineries have yet to recover fully from a mid-February deep freeze in Texas that halted their operations.

“Short-term direction will be set by the weekly U.S. inventory reports,” PVM analysts said in a note, adding that the dollar’s strength against other currencies also weighed on oil prices.

Trade data from the American Petroleum Institute late Tuesday showed U.S. crude stockpiles fell by about 1 million barrels last week, market sources said. [API/S]

Ahead of official data on Wednesday, analysts forecast a crude build of about 3 million barrels in a fourth straight weekly rise. Stocks jumped by nearly 14 million barrels in the previous week, government data showed last week. [EIA/S]

U.S. refiners are scaling back on hiring ships for longer periods, another sign of uncertainty over when global oil demand will return to pre-pandemic levels, shipping and trade sources said.

(Reporting by Stephanie Kelly in New York; additional reporting by Shadia Nasralla and Aaron Sheldrick; Editing by Marguerita Choy and David Gregorio)