By Brenna Hughes Neghaiwi

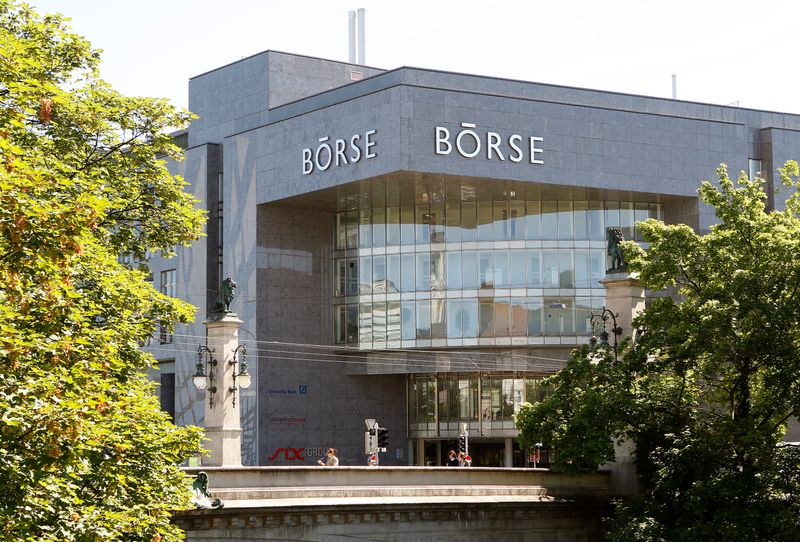

ZURICH (Reuters) -Special purpose acquisition companies (SPACS) can be listed and traded on Switzerland’s exchange from Dec. 6, Swiss bourse SIX said on Tuesday.

SPACs are shell companies that raise funds through an initial public offering to acquire a private company, which then becomes public. It serves as an alternative for companies looking to enter public markets and allows more certainty in terms of the valuation a firm can receive on the deal.

Swiss Financial Market Supervisory Authority (FINMA) earlier this year had asked bourse operator SIX to revise its listing rules for SPACs before introducing the new financing instrument.

SIX on Tuesday laid out new standards for SPAC listings, saying authorisation from all relevant authorities had now been obtained. Other bourses such as the Singapore exchange have relaxed rules to allow SPACs as a phenomenon that started off in the United States has gone global.

SPACs would principally be subject to the same requirements as other listed companies, SIX said, but would need to meet certain additional conditions and disclosure standards to help protect investors.

These included information regarding founders’ economic interests in the company, an escrow on the money raised and a three-year maximum limit for the SPAC to achieve its targeted merger or acquisition. There are also further rules and disclosures regarding the company’s merger or de-listing, or so-called “de-SPAC,” including a lockup agreement barring directors and managers from selling shares for six months.

SIX said authorisation from all relevant authorities had now been obtained.

“It’s positive for the Swiss financial center that FINMA, in cooperation with stock exchange operator SIX, is now enabling the listing of SPACs as a new alternative,” said Gregor Greber, co-founder of VERAISON Capital which earlier this year laid out ambitions to launch Switzerland’s first SPAC.

The firm would now assess the regulation in greater details before forming an evaluation of the specific rules, Gerber said.

(Reporting by Brenna Hughes Neghaiwi; additional reporting by Oliver Hirt; Editing by Miranda Murray and Emelia Sithole-Matarise)