(Reuters) – As the Russia-Ukraine conflict rages, hectic diplomacy is underway. U.S. and European Union leaders will meet and so will the NATO alliance, while all sides are courting China for support.

What kind of hit economic confidence is taking may be shown by Purchasing Managers Indexes (PMIs) for March, while central banks continue to take different paths – Norway is expected to tighten again, though China held the benchmark interest rate for corporate and household lending unchanged on Monday.

Here’s your week ahead in markets from Tom Westbrook in Singapore, Lewis Krauskopf in New York, and Sujata Rao and Dhara Ranasinghe in London.

1/TALKING SHOPS

As Russian jets pound Ukrainian cities, there have been no breakthroughs in peace talks between the two sides. But hectic diplomacy, on several fronts, continues.

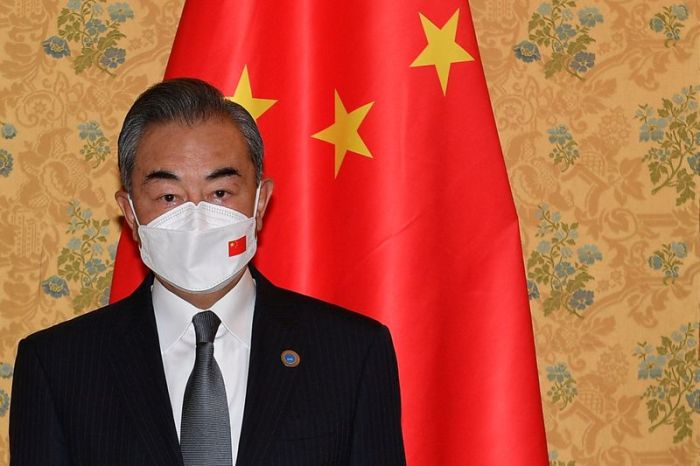

Russia is engaging the support of China, India and others, not least to sell commodities in ways that bypass Western sanctions.

Ukrainian President Volodymyr Zelenskiy is lobbying foreign parliaments and NATO for a no-fly zone over his country. NATO remains wary of direct conflict with nuclear-armed Russia. It meets on Wednesday in what its chief Jens Stoltenberg calls “a defining moment for our security”.

President Joe Biden will join the meeting, and also a mid-week EU summit in Brussels, aiming to cement the new-found cohesiveness with European allies.

But the West risks rifts with China and India, which have not condemned Russian actions. India is buying more Russian oil, and studying a rupee-rouble payment mechanism. A call between Biden and China’s Xi Jinping is unlikely to dent China’s efforts to occupy the space vacated in Russia by Western firms.

Graphic: Maps: Tracking the Russian invasion of Ukraine Ukraine conflict map: https://graphics.reuters.com/UKRAINE-CRISIS/gdpzybkrlvw/bigmap.jpg

For an interactive version of the graphic: https://graphics.reuters.com/UKRAINE-CRISIS/zdpxokdxzvx/index.html

2/LITMUS TEST

It’s flash PMI week. The forward-looking gauge of economic activity for March will be a litmus test of sorts of the impact from the war in Ukraine.

Generally, PMIs have held above the 50-mark that divides contraction from expansion. But after the ZEW index showed a record slump in German investor morale in March, a recession in Europe’s biggest economy cannot be ruled out.

The ZEW hardly registered with markets, more focused on central banks’ efforts to stamp on inflation.

But as soaring energy costs squeeze real incomes and consumption, a seriously downbeat batch of PMIs might set the recession warning bells a-ringing.

Graphic: What impact will war in Ukraine have on the world economy?: https://fingfx.thomsonreuters.com/gfx/mkt/jnpwebmxzpw/theme1603.PNG

3/S&P 500 THEN AND NOW

Two years ago on March 23 2020, the S&P 500 index troughed out from a COVID-related nosedive. Since then, it has rallied some 90%, thanks to massive government stimulus and unprecedented support from the Federal Reserve.

Now, markets face a new set of worries. Chief among them: whether the Fed, which lifted rates on Wednesday for the first time since 2018,– will be able to fight soaring inflation without driving the economy into recession.

Ten-year Treasury yields have risen nearly 70 basis points this year, while 2-year yields have jumped 120 bps. If the gap between the two segments, currently around 20 bps, turns negative, it could mean an economic recession is coming.

After the Fed laid out a steeper rate-hike trajectory than many expected, markets will watch upcoming data – besides PMIs, consumer sentiment, new home sales and durable goods are due. They may indicate whether the S&P 500 can claw back a year-to-date 8% loss.

Graphic: US stock market’s rebound from COVID-19: https://fingfx.thomsonreuters.com/gfx/mkt/lbpgnzkbkvq/Pasted%20image%201647449215498.png

4/ THE HAWK AND THE DOVE

Norway was the first developed nation out of the blocks with post-pandemic policy tightening, having raised interest rates in September and December. On March 24 it will hike again, taking rates to 0.75%.

With inflation above the 2% target and predictions of 3.6% GDP expansion in 2022, banks expect as many as four rate rises this year. The upcoming meeting will be the first one chaired by new governor Ida Wolden Bache.

Expect no hawkishness from the Swiss National Bank, which meets the same day. It’s expected to sit tight and is in no hurry to raise its -0.75% rate, the world’s lowest.

Although February’s 2.2% inflation was the highest since 2008, tighter policy risks more Swiss franc appreciation, an important consideration for the export-heavy economy. The SNB made a rare verbal intervention recently and also stepped up foreign currency buying.

Graphic: Norway rate rise: https://fingfx.thomsonreuters.com/gfx/mkt/znpnenykzvl/Pasted%20image%201647547667197.png

5/BOTTOMS UP? China’s State Council assurances that policy easing really is on the way and authorities will be gentler on markets gave Chinese stocks their biggest bounce in more than a decade. The challenge now is to deliver meaningful support without spooking investors about the state of the economy. But on Monday, benchmark Loan Prime Rates were held unchanged <CNYLPR1Y=CFXS>.

But many expect policy easing to come via a cut banks’ reserve requirement ratios or by lowering medium-term rates that were left on hold this month Either way, investors will need to see something soon.

Graphic: China stocks: https://fingfx.thomsonreuters.com/gfx/mkt/gdvzybzddpw/Pasted%20image%201647548107794.png

(Compiled by Sujata Rao; Editing by Frank Jack Daniel)