By Pete Schroeder and Michelle Price

WASHINGTON (Reuters) – The U.S. Senate will vote on a bill next week to ease bank rules, bringing Congress a step closer to passing the first rewrite of the Dodd-Frank reform law enacted after the 2007-2009 global financial crisis.

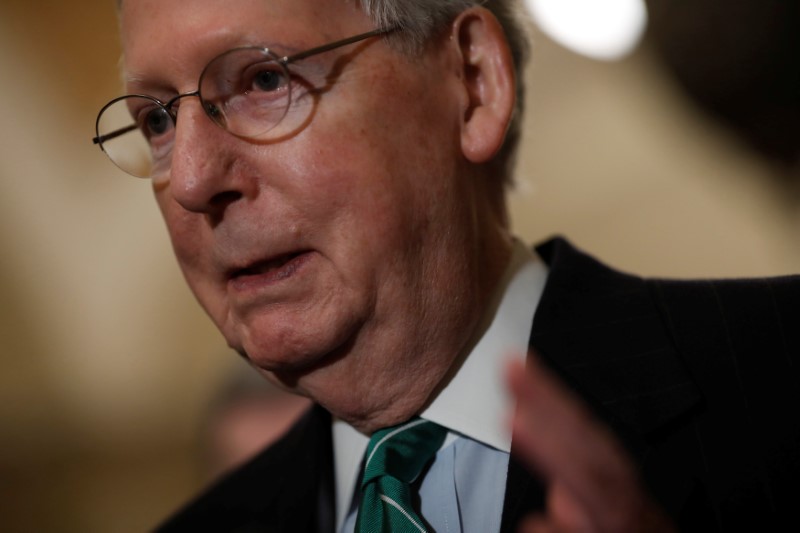

Senate Majority Leader Mitch McConnell told reporters on Thursday the chamber would consider legislation penned by Senate Banking Committee Chairman Mike Crapo, which would relax rules on small and mid-size lenders. McConnell later on Thursday scheduled a procedural vote for next week.

The move by McConnell to take the bill to the Senate floor will be cheered by small and mid-sized U.S. banks, which have long pushed for a rewrite of Dodd-Frank.

The Republican leadership regards the bill as a priority and is looking to expedite its passage, making it unlikely big banks will secure last-minute changes, several people briefed on the matter told Reuters.

McConnell did not comment further on the Crapo bill.

The bill is widely expected to become law by the summer. Thirteen Democrats in the Senate, which has a slim Republican majority, have signed on as backers and nearly every Republican is expected to vote in favor.

Republican critics say the 2010 Dodd-Frank law went too far and curbs banks’ ability to lend, while many Democrats say it provides critical protections for consumers and taxpayers.

Republicans have tried for years to revise the law but only recently have some Democrats begun to support tweaks.

Crapo’s bill would ease restrictions on small banks and credit unions, but also includes a number of provisions beneficial to all but the largest U.S. banks.

Most notably, the bill would raise the threshold at which banks are considered systemically risky and subject to stricter oversight to $250 billion from $50 billion.

It also exempts banks with less than $10 billion in assets from rules banning proprietary trading.

HOUSE APPROVAL NEEDED

One key question for the banking industry is how Crapo will manage the tricky process of reconciling his text with the House of Representatives, which must also approve the bill before it becomes law, without losing Democratic support.

The Republican-led House has taken a much more aggressive stance on rolling back Dodd-Frank. Crapo’s counterpart, House Financial Services Chairman Jeb Hensarling, has already shepherded passage of dozens of smaller bills loosening its rules.

Crapo is privately considering adding some of the bipartisan House bills to his Senate version, the people said. That approach would allow the House to quickly approve the final Senate version, rather than forcing the two chambers to thrash out their differences in a lengthy, more contentious open process.

President Donald Trump, who supports the bill as part of his agenda to stimulate economic growth by slashing red tape, could then sign the bill into law within weeks.

“Chairman Hensarling has done a good job at moving bipartisan pieces of legislation through the House, but it will be a difficult task to maintain that delicate balance in the Senate due to the Senate’s current composition,” said Dina Ellis Rochkind, a lawyer at Paul Hastings in Washington and former Senate Banking Committee staffer.

“Nonetheless, the Senate version of the legislation has a good chance of becoming law with a few changes from the House,” she added.

(Reporting by Susan Cornwell, Pete Schroeder and Michelle Price; Editing by Andrea Ricci and Peter Cooney)