(This Septemebr 30 story corrects to read “views” (not “vote”) in paragraph 15)

PARIS (Reuters) – French utility Engie <ENGIE.PA> moved closer to selling its stake in waste and water group Suez <SEVI.PA> to Veolia <VIE.PA> on Wednesday, as it welcomed a sweetened 3.4 billion euro offer ($4 billion) and obtained extra time to seal the deal.

The breakthrough follows weeks of acrimonious exchanges between the parties, as Suez rejected Veolia’s overtures for Engie’s 29.9% stake, which would be a prelude to a full takeover offer.

The French government, an Engie shareholder, was drawn into the saga as hostilities spiralled, and had urged the companies to take their time.

Engie said its board viewed Veolia’s revised offer favourably, compared to its earlier 2.9 billion-euro-bid.

But it asked until Oct. 5 to finalise the takeover terms, demanding Veolia’s unconditional commitment to not launch a hostile tender offer for Suez.

Veolia agreed to the extension, after it had initially given Engie until midnight on Wednesday to respond.

Veolia had already said it wanted to keep any takeover move on Suez friendly, and offered a six-month window to get the blessing of Suez’s board for any bid that would follow its purchase of Engie’s stake.

But it had also said any tender offer would be conditional on Suez dismantling a foundation set up in recent weeks to house its French water business – a manoeuvre seen as a hurdle for a Veolia takeover.

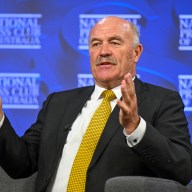

Engie Chairman Jean-Pierre Clamadieu told reporters the utility wanted Veolia to not tie any offer to the foundation.

Engie will try to persuade Suez to reverse course on the foundation by the Oct. 5 deadline, two sources familiar with the matter said.

NO ALTERNATIVES

Veolia has argued that its takeover of Suez would save costs and make the merged global waste management and water company better equipped to take on rivals, including from China.

Suez has decried the approach as opportunistic and said it could lead to job losses.

Engie had already earmarked its 32% stake in Suez for sale, but was holding out for a higher price. It had said it was open to alternative offers, should Suez produce a different suitor.

But Engie’s Clamadieu said it was too late for an alternative, even though the group had received a “vague show of interest” on Wednesday without sufficient details on price, or the funds or companies involved.

Clamadieu added that the French state had been aligned in its views with independent directors when Engie’s board met to discuss Veolia’s latest offer.

(Reporting by Dominique Vidalon, Matthieu Protard, Blandine Henault, Gwenaelle Barzic, Sarah White and Michel Rose; editing by Louise Heavens, Mark Potter, Alexander Smith and Richard Chang)