(Reuters) – The Bank of Japan maintained its massive stimulus on Friday and warned of heightening risks to a fragile economic recovery from the Ukraine crisis, reinforcing expectations it will remain an outlier in the global shift towards tighter monetary policy.

The BOJ’s dovish tone is in stark contrast with the U.S. Federal Reserve and the Bank of England, which raised interest rates this week to stop fast-rising inflation becoming entrenched.

As widely expected, the BOJ maintained its short-term rate target at -0.1% and that for the 10-year bond yield around 0% at the two-day policy meeting that ended on Friday.

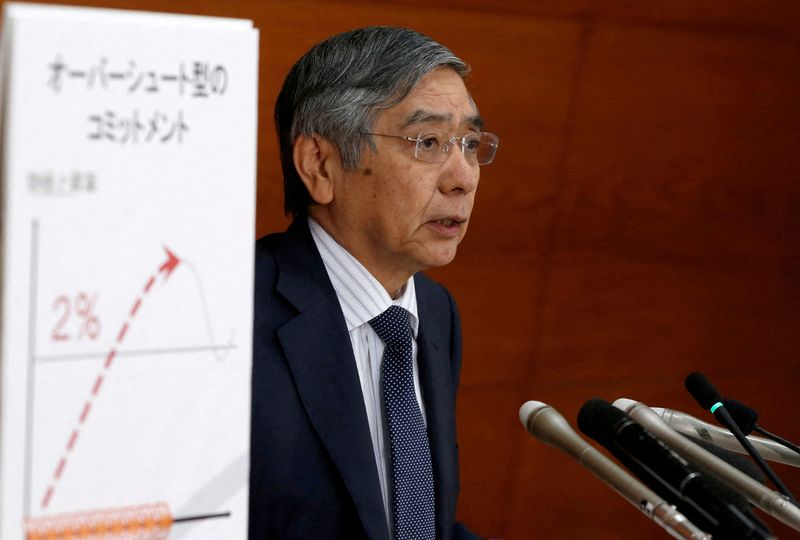

Following are excerpts from BOJ Governor Haruhiko Kuroda’s comments at his post-meeting news conference, which was conducted in Japanese, as translated by Reuters:

UKRAINE CRISIS’ IMPACT

“The biggest impact on Japan’s economy from the Ukraine crisis is through rising raw material costs. Japan’s inflation is likely to accelerate clearly for the time being. But it also weigh on the economy from a longer-term perspective by pushing down corporate profits and households’ real income.”

“Developments regarding the Ukraine crisis are highly uncertain. We will closely watch whether they inflect negative impact on Japan’s economy that is still in the midst of recovering from the pandemic’s hit.”

INFLATION

“It will depend on future crude oil price moves and the government’s steps to cushion the blow. But we could see inflation move at around 2% for some time from April. Rising costs will push up inflation. But it weighs on households and corporate profits, and could have a negative impact on Japan’s economy. We will maintain our powerful monetary easing patiently to achieve sustainable, stable inflation.”

WEAK YEN

“A weak yen affects Japan’s economy in different ways as the country’s economic and trade structure changes. But overall, there’s no change to how a weak yen is basically positive for Japan’s economy. It’s true the impact is felt unevenly among sectors, corporate size and economic entities…”

“The recent rise in import costs is driven more by surging raw material costs than by a weak yen.”

“The relationship between interest-rate differentials and exchange-rate moves isn’t clear-cut … I don’t think interest rate differentials alone would weaken the yen further.”

STAGFLATION

“I don’t think Europe, the United States and Japan will face stagflation”

INFLATION AND MONETARY POLICY

“There’s a chance Japan will see inflation move around 2% from April onward. But most of that is due to rising commodity prices, so there’s no reason to tighten monetary policy. Doing so would be inappropriate. We need to tweak monetary policy if inflation expectations or wages see second-round effects. But Japan isn’t in such a situation.”

JAPAN’S ECONOMY

“So far the spring wage negotiations are turning very positive results. It’s hard to predict how the Ukraine situation develops, so that needs close attention. But at this stage, I don’t think the positive economic cycle has been disrupted.”

BOJ RESPONSE TO WEAK YEN

“Exchange rate policy falls upon the jurisdiction of the finance ministry. The BOJ does not need to, and does not have the power to influence exchange rates. But it’s true exchange rate moves affect the economy and prices, so we’re watching moves carefully.”

PRICE RISE

“Japan’s consumer inflation may move around 2% from April onward but that’s unlikely to persist for a long period of time … Price rises driven mostly by cost-push inflation are basically temporary and unlikely to be sustained.”

JAPAN INFLATION OUTLOOK

“When we look at various data, short-term inflation expectations are heightening, but medium- and long-term expectations are barely moving. At least for now, we’re not seeing any major change in Japan’s inflation expectations.”

(Reporting by Leika Kihara; Editing by Rashmi Aich)