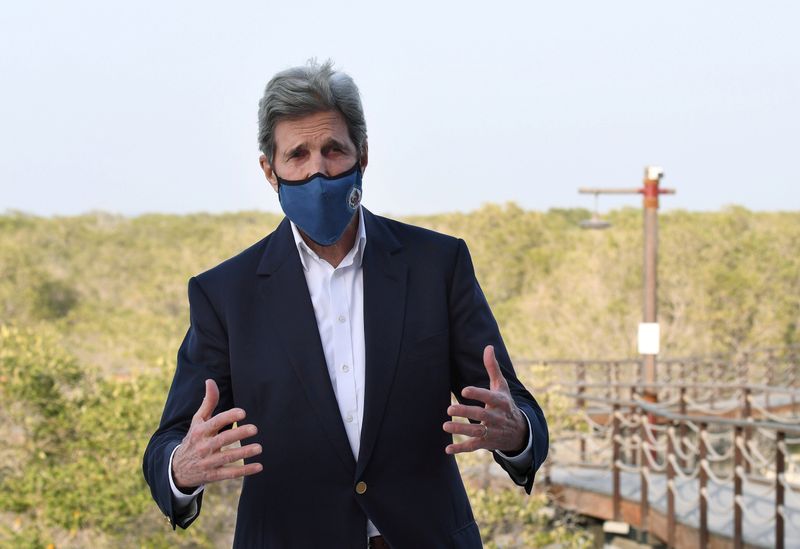

WASHINGTON (Reuters) – Requiring financial institutions and companies to disclose climate change risks will trigger huge shifts in capital investments around the world, U.S. climate envoy John Kerry said on Wednesday, adding that U.S. President Joe Biden plans to issue an executive order on the issue soon.

Kerry, speaking on a panel with International Monetary Fund chief Kristalina Georgieva, gave no details about the executive order, and the White House had no further comment. Kerry noted that the European Union had already adopted such requirements.

Georgieva said the IMF was working closely with the Group of 20 major economies and central banks to standardize reporting of the risks, together with central banks, and then stress-test the global financial system for its response to those risks.

The changes come amid a surge in global activity to address climate risks following Biden’s inauguration and his decision to re-enter the 2015 Paris climate accord abandoned by his predecessor, Donald Trump. Biden will host a leaders’ summit on climate change later this month.

The IMF on Wednesday launched a new “Climate Change Indicators Dashboard,” which will inform economic policy decisions by bringing together data on greenhouse gas emissions, economic activity, trade in environmental goods, green finance, government policies and physical and transition risk.

“We have to make the invisible visible – the transition risks that banks are carrying because they’re investing in high-carbon activities that over time are going to be phased out, and the physical risk, investments in highly vulnerable coastal areas, or in agriculture that could be affected by floods or by droughts,” she said.

One key concern is that companies could be left with stranded assets – holdings that turn out to be worthless because of changes associated with a transition to low-carbon energy sources. But there are also physical risks such as the increased incidence of natural disasters.

Georgieva said finance officials from the Group of 20 major economies agreed during a virtual meeting on Wednesday that it was “increasingly urgent” to do more to tackle climate change and promote environmental protection.

She said an IMF analysis found that climate risks were not sufficiently reflected in equity valuations, which could lead to economic losses. She said investment managers overseeing some $25 trillion in investments were also demanding greater transparency about the risks.

“The new IMF Dashboard will help fill data gaps, so policymakers can undertake the macroeconomic and financial analysis that underpins effective policies,” Georgieva said.

Kerry said increased disclosure of risks and new tax incentives would spark “significant amounts” of new investment to help solve climate-related problems.

“Suddenly, people are going to be making evaluations and considering long term risks to the investment based on the climate crisis,” he said, adding his view that demand for new technologies in batteries and alternative fuel, among others, would spark increased activities by venture capitalists.

Kerry drew parallels to the rise of telecommunications in the 1990s, which quadrupled the existing market.

(Reporting by Andrea Shalal in Washington; Additional reporting by Timothy Gardner in Washington; Editing by Matthew Lewis)