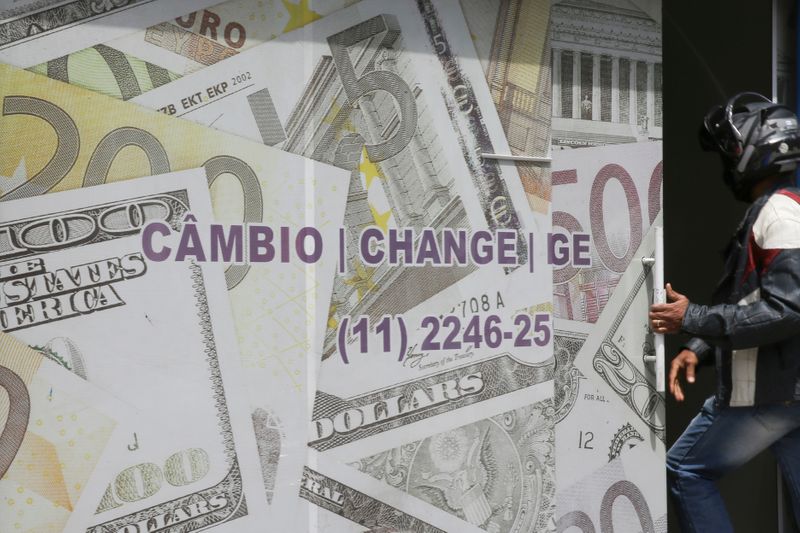

(Reuters) – The cost of betting on euro downside against the dollar in currency derivatives markets fell on Tuesday to the lowest since mid-March, after a Franco-German proposal for a recovery fund and joint debt boosted the single currency.

One-month euro-dollar risk reversals showed the implied volatility premium for euro puts against calls has shrunk to the lowest since March 17 at around minus 0.23% <EUR1MRR=FN>. Puts are options that allow holders to sell the euro at a certain price while calls confer the right to buy.

The euro has risen more than 1% versus the dollar since the plan was unveiled on Monday for a 500-billion euro fund and joint debt issuance <EUR=EBS>.

(Reporting by Sujata Rao; Editing by Tommy Reggiori Wilkes)