(Reuters) – Federal Reserve policymakers charged with guiding the economy through its worst collapse in a century diverged broadly this week over what to expect in coming months, with narratives of an unexpectedly fast recovery vying against warnings of a resurgence in the coronavirus pandemic and deepening economic malaise.

The central bank’s monetary policy is already set on a loose and supportive course, and in broad contours at least is unlikely to change much for the next few years.

But in a series of starkly contrasting public statements, policymakers offered differing views on how long it will take the U.S. economy to recover from the crisis brought on by the pandemic.

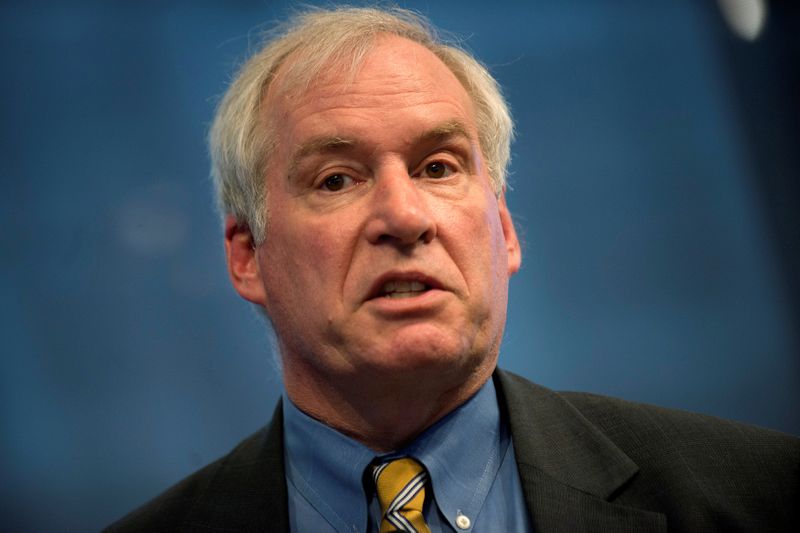

Boston Fed President Eric Rosengren and Chicago Fed President Charles Evans offered gloomy views on the economic outlook and said Congress needs to enact more fiscal stimulus.

But St. Louis Fed President James Bullard offered a bullish view on the economic recovery, and Richmond Fed Bank President Tom Barkin said he didn’t think the Fed was too far off from its 2% inflation target.

The comments came as Fed Chair Jerome Powell gave the last of three days of testimony before Congress, again on Thursday stressing the need for more fiscal stimulus. Powell warned of the risk that as households spend the last of their stimulus checks and unemployment benefits, there will be a cutback in spending, with some Americans possibly losing their homes.

Rosengren, who self-identified this week as one of the more pessimistic members of the U.S. central bank’s policy-setting Federal Open Market Committee, reiterated on Thursday that he expects a resurgence of coronavirus infections in the fall and winter — a view not uncommon among epidemiologists who study disease transmission.

Rosengren said the U.S. economy is far from the Fed’s goals of maximum employment or 2% inflation, and interest rates will stay low for several years — views shared by most Fed policymakers speaking since last week’s policy-setting meeting.

Rosengren, again like most of his colleagues, said Congress needs to provide more fiscal aid to help low- to middle-income consumers, small businesses and state and local governments get through the crisis.

“I’m very worried that we’re pretty far away from what we think is maximum employment and I think there are going to be significant headwinds to getting there quickly,” he told Yahoo Finance Thursday.

Bullard pushed back on such dire forecasts Thursday, saying he thought COVID-19 fatality rates were “unlikely to reach the level of March and April” — a view that epidemiologists also broadly share, even as they worry about a rise in cases and deaths in coming months.

Improving treatments and increased vigilance among high-risk individuals should allow the economic recovery to continue, Bullard said.

Even if policymakers embrace that more positive outlook, Bullard said, the Fed’s new framework means the central bank will keep rates low for longer to address shortfalls in employment and allow more time for inflation to pick up.

The Fed said last week that rates would remain near zero until the economy reaches maximum employment, and inflation hits the Fed’s 2% target and is on track to stay moderately above 2% for some time.

The central bank could reach that 2% inflation target as early as next year, Bullard said, a forecast more aggressive than most of his colleagues. Evans, who spoke Thursday for the third time this week, says he sees inflation reaching 2% by the end of 2023.

The Richmond Fed’s Barkin agreed that the new approach could help to modestly increase inflation, and said he didn’t think the Fed was too far off from its 2% target.

“With rounding, you could even call it on target,” Barkin said, adding that he would also have been comfortable with targeting a range of 1.5% to 2.5%.

However, policymakers said it may take more time for the Fed to achieve its goal of maximum employment, and several officials called on Congress to roll out more aid for unemployed Americans, small businesses and state and local governments.

Republican and Democratic lawmakers have failed to pass any new aid since their March $2.3 trillion package, credited with helping the U.S. economy avoid even worse job loss and business failures than it has suffered. But a key lawmaker on Thursday said that Democrats in the House of Representatives are working on a $2.2 trillion stimulus package that could be voted on next week.

Much of the aid to small businesses has been depleted and extra funds funneled to the unemployed have run out. Lawmakers need to extend aid to the workers most affected by job losses, including low-income workers and Black and Hispanic communities, the Chicago Fed’s Evans said.

“We are taking a very serious and unnecessary risk if we do not extend federal assistance to out-of-work households,” Evans said in remarks to the Illinois Chamber of Commerce.

(Reporting by Jonnelle Marte, Howard Schneider and Ann Saphir; Editing by Leslie Adler)