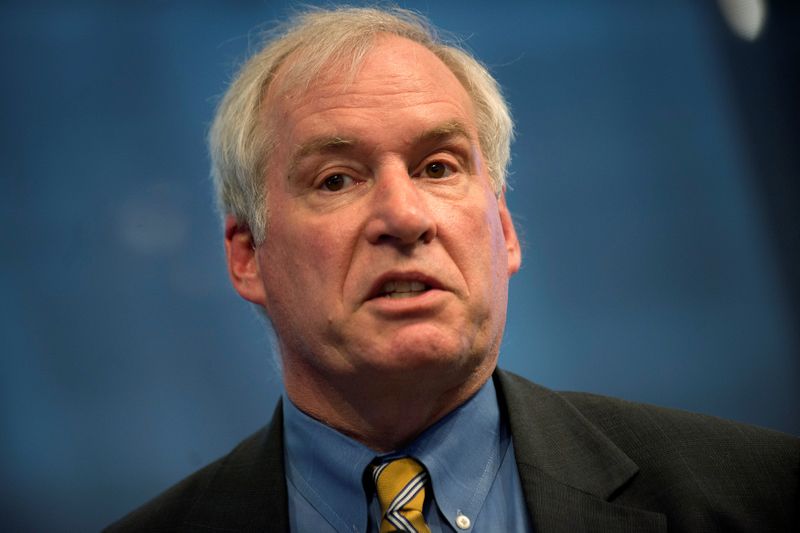

(Reuters) – The debt some service-sector firms built up before the coronavirus pandemic makes the U.S. economy more vulnerable and could slow the pace of the recovery, risking lasting damage to the women and minority workers most affected by job losses, Boston Federal Reserve Bank President Eric Rosengren said Tuesday.

Since women and Black and Hispanic workers are overrepresented in those industries, they are at greater risk of losing their jobs or dropping out of the labor force when a company fails, he said.

“Those segments of the labor market most affected by amplified business cycles … can be populated by those workers who are most vulnerable and least able to adapt to the changed economic environment,” Rosengren said during a virtual conference. “That imbalanced human toll is a bad outcome for democracy as well as the economy.”

The policymaker said the U.S. central bank will need to balance supporting the economy during the ongoing pandemic with protecting financial stability. “With a second wave of infections underway, my sense is that more fiscal and monetary accommodation is appropriate,” Rosengren said.

But divisions over the election make it hard to predict how much aid will be delivered. “While we have a president-elect, not everybody agrees on who the president elect is,” he said.

Fed officials should also be aware that the central bank’s new framework – which allows for rates to stay low until the labor market reaches full employment and inflation rises to an average of 2% over time – could encourage some firms to take on more leverage, Rosengren said.

Asked about market stability, Rosengren said the Fed needs to keep its eye on liquidity issues in money markets after they required intervention both during the last financial crisis and again earlier this year. “The money market situation is quite disturbing,” Rosengren said.

(Reporting by Jonnelle Marte; Editing by Chizu Nomiyama)