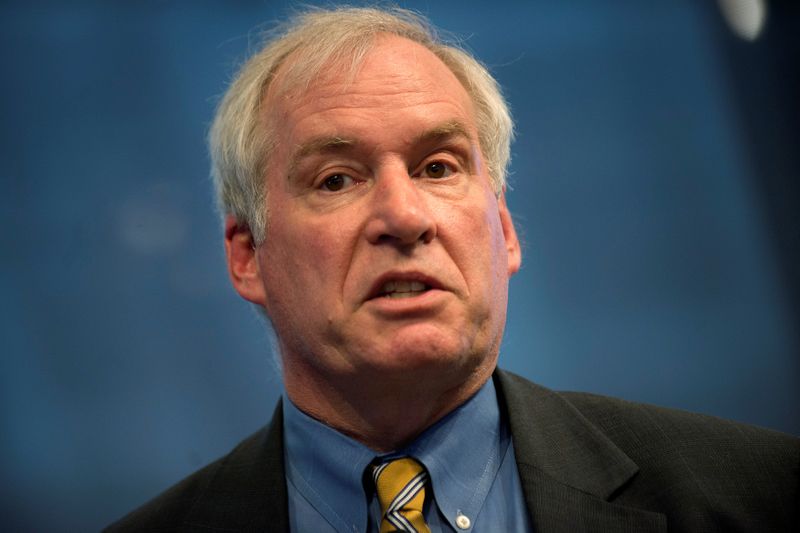

(Reuters) – The U.S. economy could see a strong rebound in the second half of this year as vaccinations become widely available, but the virus is still driving the economy and monetary policy will remain accommodative, Boston Federal Reserve Bank President Eric Rosengren said Tuesday.

“The pandemic is likely to continue to be a problem for public health and the economy until widespread vaccinations take hold,” Rosengren said in remarks prepared for a virtual event organized by the Greater Boston Chamber of Commerce. “Nonetheless, with substantial fiscal and monetary support, I expect a robust recovery starting in the second half of this year.”

Rosengren said he expects consumption to rise, and for the unemployment rate to drop, in the second half of the year as vaccinations are distributed.

Low interest rates should continue to support the housing market and the labor market could see strong gains over the next two years, Rosengren said. But he does not expect inflation to reach the Fed’s 2% inflation target in that same time frame, suggesting that short-term interest rates are likely to stay “very accommodative,” he said.

As part of that support, the central bank is likely to continue purchasing government and mortgage-backed bonds at the current pace at least through the end of this year, Rosengren said. “I expect it to be a little while before we’re even talking about tapering on our purchases,” he said.

Rosengren also offered an update on the Fed’s Main Street Lending Program, which saw a surge in demand and participation in its final month after it was announced the program would close at the end of 2020.

Over 1,800 companies tapped the program last year, taking out more than $16.5 billion in loans, Rosengren said. The program also saw a last-minute boost in lender participation, with about 45% of the total pool of lenders participating in December for the first time.

(Reporting by Jonnelle Marte; Editing by Chizu Nomiyama and Andrea Ricci)