Transit, education among new credits for 2006 return

Q: I am a stay-at-home mom with two children. My eldest is 12 and my youngest is four. Must I report the receipt of the Child Tax Benefit (CTB) and can I claim a deduction for part of the amount?

A: Taxpayers preparing their 2006 personal tax return should be aware of the many changes brought down by last year’s budget. Starting last July 1, all taxpayers with children under six years old qualify to receive the new Universal Child Care Benefit (UCCB). Families receive $100 per month per child under six. Recipients should receive an “RC62” for $600 per child. This amount is taxable and reported as income by the lower-income spouse. Recipients of the Child Tax Benefit (not the same as UCCB) do not have to report CTB as it continues to be non-taxable.

More changes you need to know:

-

Employment credit: All employed taxpayers may claim the $250 non-refundable tax credit. Receipts are not necessary for this claim.

-

Public transit pass credit: Transit riders with monthly or longer-term passes should save receipts to claim this credit. Taxpayers can combine receipts for his/herself, spouse and children.

-

Increased education amounts and new textbook credit: Students attending post-secondary educational institutions in Canada (and certain international ones) qualify for tuition, education and textbook credits. The education and textbook credit is based on a student’s full or part-time attendance. Full-time attendance — education credit, $400 per month; textbook credit, $65 per month; Part-time attendance — education, $120 per month; textbooks, $20 per month for part-time. Students do not require receipts for the textbook credit. Parents should file tax returns for students and transfer unused credits from their kids.

-

Scholarship, Fellowship and bursary income: Students in receipt of these amounts are fully exempt from tax.

Carefully check your tax return and not miss out on these changes.

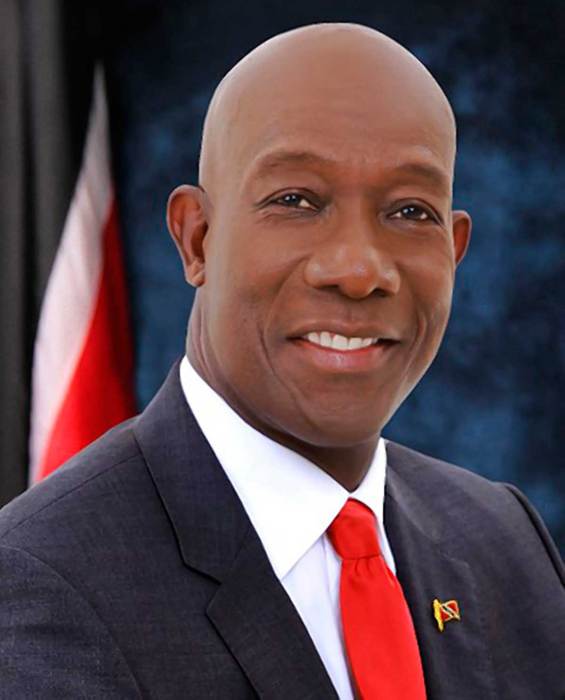

Henry Choo Chong, CGA provides accounting and tax services to individuals and businesses in the GTA (416-590-1728, ext. 304). E-mail questions for Money Matters to choochonghcga@yahoo.ca.