(Reuters) – A number of large block trades on Friday which investors said caused big drops in the stocks of a clutch of companies has raised speculation about what was behind them, with Goldman Sachs said to be a bank involved in the sales. Shares in ViacomCBS and Discovery tumbled around 27% each onFriday, while U.S.-listed shares of China based Baidu andTencent Music plunged during the week, dropping as much as 33.5%and 48.5%, respectively, from Tuesday’s closing levels.

Investors and analysts on Friday cited large blocks ofshares in both Viacom and Discovery companies as being put inthe market on Friday, calling them massive volumes, likelyexacerbating the declines. Viacom also on Friday was downgradedby Wells Fargo.

A source familiar with the matter said on Saturday thatGoldman Sachs Group Inc was involved in the large blocktrades.

Bloomberg and the Financial Times on Saturday reported thatGoldman liquidated more than $10 billion of stocks in the blocktrades.

The Financial Times reported that Goldman toldcounterparties that the sales were prompted by a “forceddeleveraging”, citing people with knowledge of the matter.

CNBC reported https://www.cnbc.com/2021/03/27/archegos-capital-forced-position-liquidation-contributes-to-viacom-discovery-plunge.html that the selling pressure was due to liqudation of positions by family office Archegos Capital Management, citing a source with direct knowledge of the situation.

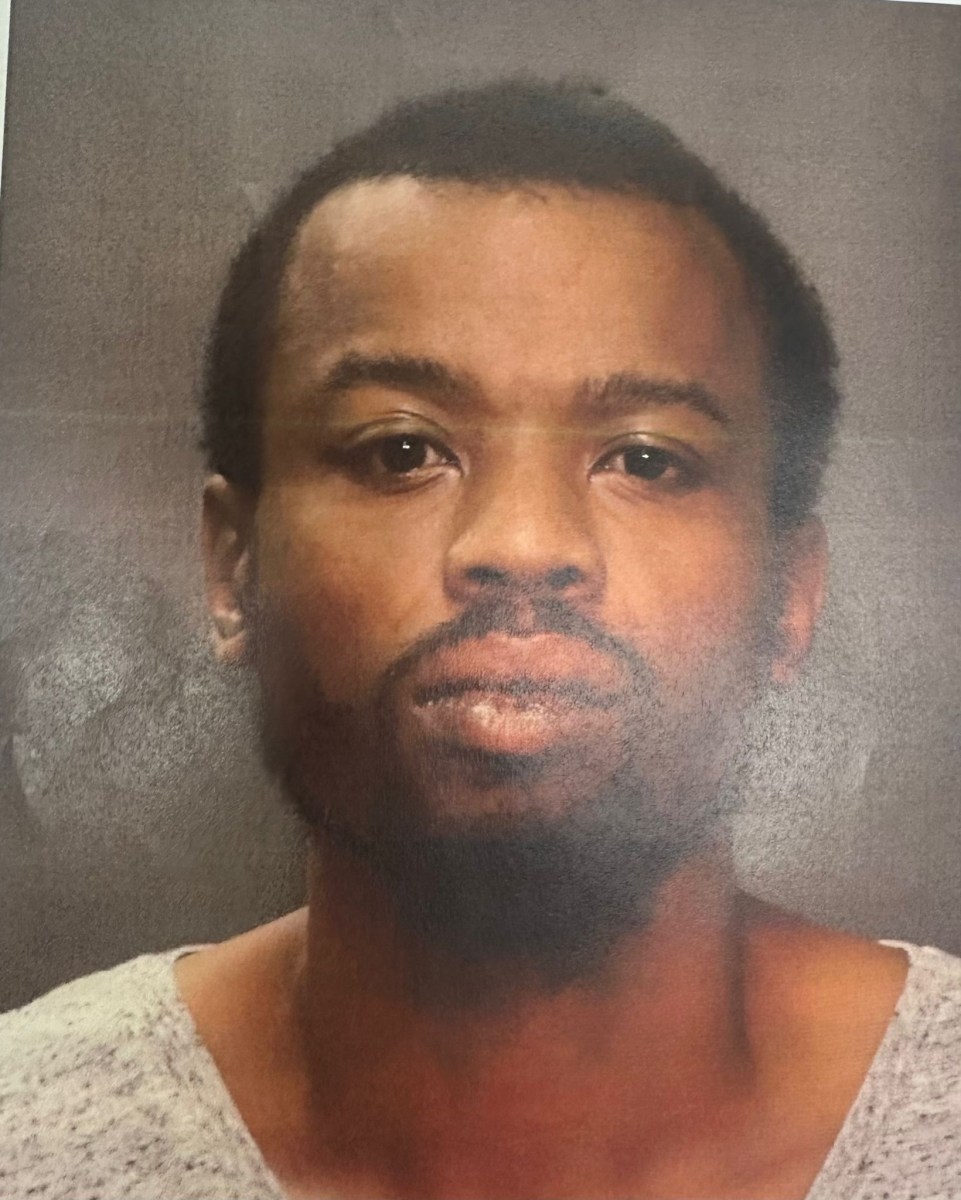

A person at Archegos who answered the phone declined to comment. Archegos was founded by Bill Hwang, who founded and ran Tiger Asia according to a page capture https://web.archive.org/web/20210124211426/https://www.archegoscapital.com/management of the fund’s website. Tiger Asia was a Hong Kong based fund fund https://www.reuters.com/article/togerasia-hedgefund/update-1-hedge-fund-tiger-asia-to-return-investor-money-idUKL4E8JE2XP20120814 that sought to profit on bets on securities in Asia.

An email to clients seen by Bloomberg News https://bloom.bg/3lYOrZm said Goldman sold$6.6 billion worth of shares of Baidu Inc, TencentMusic Entertainment Group and Vipshop Holdings Ltd, before the U.S. market opened on Friday, the Bloombergreport on Saturday said.

Following this, Goldman sold $3.9 billion worth of shares inViacomCBS Inc, Discovery Inc, Farfetch Ltd, iQIYI Inc and GSX Techedu Inc,according to the report.

The Financial Times reported that Morgan Stanley sold $4billion worth of shares earlier in the day, followed by another$4 billion in the afternoon.

Morgan Stanley and Goldman Sachs declined to comment.

(Reporting by Juby Babu in Bengaluru; Additional reporting by Ken Li, Megan Davies and Sinead Carew; Editing by Diane Craft and Daniel Wallis)