(Reuters) – For the first time in years, Goldman Sachs Group Inc’s <GS.N> having a sizeable trading business and a tiny consumer bank seems like a good idea.

Quarterly earnings of Goldman missed Wall Street expectations on Wednesday after the fifth-largest U.S. bank took big markdowns on its investment portfolio and set aside $937 million for possible losses on corporate loans due to the coronavirus-driven downturn.

Even so, Goldman Sachs’s exposure to losses from the global pandemic that has so far killed more than 131,000 people, shut down businesses and left huge portions of the workforce unemployed is small compared to big-bank rivals that have reported results this week. (https://graphics.reuters.com/CHINA-HEALTH-MAP/0100B59S39E/index.html)

Loss provisions at JPMorgan Chase & Co <JPM.N>, Citigroup Inc <C.N>, Bank of America Corp <BAC.N> and Wells Fargo & Co <WFC.N> were four to nine times larger than Goldman’s, mostly because those banks have bigger consumer-lending businesses.

Goldman’s trading businesses reported their best results in five years and accounted for nearly 60% of the bank’s overall first-quarter revenue, compared with 40% for all of 2019.

Even though Goldman’s profit fell short of the average analyst prediction, its shares rose as much as 1.9% on Wednesday even as the broader market declined and other big banks fell sharply on loan-loss concerns. Goldman closed up 0.2% at $178.52.

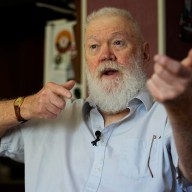

“It really is a favorable business mix for this quarter,” said David Konrad, a bank analyst at D.A. Davidson & Co.

Goldman’s $5.2 billion in trading revenue was up 28% from the year-ago period. Its debt and equity underwriting businesses also did well, and executives suggested the burst of capital-markets activity that drove its first-quarter results could carry through in the second quarter.

The irony, Konrad said, is that the market is happy about short-term gains that previously haunted Goldman Sachs as it has tried to recalibrate its business model for the long-term.

“This dynamic may shift to a far more difficult environment for capital markets and investment banking and less provision headwinds,” Konrad said. “It’s a bit of timing for all of these banks.”

MOVE AWAY FROM TRADING

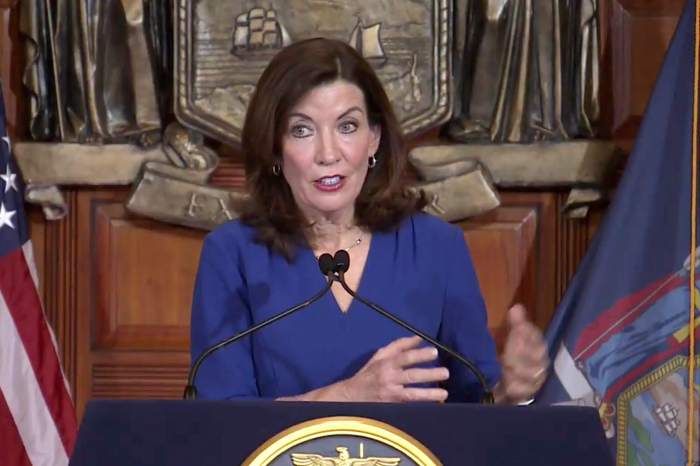

Goldman Sachs’ chief executive officer, David Solomon, has been trying to move the bank away from trading, which has fallen out of favor due to regulations imposed since the 2008 financial crisis, and because of its inherent volatility.

Solomon has been implementing a plan to expand into consumer banking, launch a treasury services business for corporations, grow wealth management, lend more to companies and shift trading to focus on asset managers, in addition to hedge funds.

It is hard to tell from the outside exactly what transactions boosted Goldman’s trading businesses, but gains seemed widespread. The bank highlighted better results in currencies, credit products, commodities, interest-rate products, market-making in equities and equities derivatives, and financing for trades. The only negative was mortgage trading.

Trading helped offset some $890 million in markdowns Goldman had to take on stocks, bonds, loans and private-equity assets it holds on its balance sheet as investments, as well as the credit-loss provisions for corporate loans it has extended.

Overall, the bank’s profit fell 49% to $1.1 billion, or $3.11 per share, from $2.2 billion, or $5.71, in the first quarter of 2019.

Analysts on average had expected a profit of $3.35 per share, according to the IBES estimate from Refinitiv.

Its net revenue was flat at $8.7 billion, compared to an average estimate of $7.9 billion.

On a conference call with analysts, Goldman executives said trading activity has remained robust so far in the second quarter and that there is a strong pipeline of deal and underwriting activity that may continue to boost results in the near term.

They also emphasized that the bank has no plans to change course from the strategic vision Solomon laid out before the coronavirus pandemic began strangling the economy.

Even though its trading business stole the spotlight in the first quarter, Goldman added 80 clients to its recently launched corporate cash transactions business, grew consumer deposits by $12 billion and maintained previous operational targets.

Goldman may have to cut costs further and add to loan-loss provisions if the coronavirus downturn continues, but will not stray from a strategic plan management laid out in January, executives said.

“The strategic direction we laid out for the firm remains no less compelling,” Solomon said.

(Reporting by Anirban Sen in Bangalore and Elizabeth Dilts Marshall in New York; Additional reporting by Matt Scuffham and David Henry; Writing by Lauren Tara LaCapra; Editing by Bernard Orr and Leslie Adler)