WASHINGTON (Reuters) -The U.S. Treasury said on Wednesday that about $15 billion was paid to families in the first monthly installment of the Child Tax Credit that was expanded under President Joe Biden’s $1.9 trillion COVID-19 legislation known as the American Rescue Plan.

Treasury said that the July payments went to families with nearly 60 million eligible children. Eligible families received an initial monthly payment of up to $300 for each child under 6-years-old and up to $250 for each child age 6-17.

The ARP made half of the tax credit for the 2021 tax year payable in advance by the Internal Revenue Service in monthly installments from July through December this year, with the remainder payable upon the filing of tax returns in 2022.

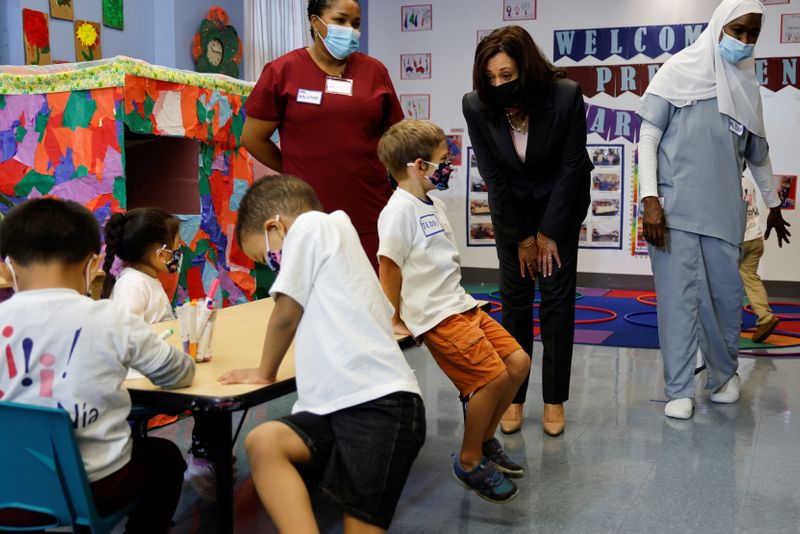

The Biden administration has proposed making the monthly advance payment of the tax credit permanent as a means to reduce child poverty. The Treasury estimated that under previous rules, families with more than 26 million children would have received less than the full, expanded credit because their incomes were too low.

A senior Biden administration official told reporters on a conference call that 35.2 million families would be receiving the July payment, but an IRS estimate of 39 million families receiving the payments would soon be achieved, as some have yet to register.

(Reporting by David Lawder; Editing by Christopher Cushing and Sam Holmes)