Millennial homeowners — yes, they do exist — are a careful lot, according to Better Homes & Gardens’ ninth annual survey of trends in U.S. homeownership. This year’s focus was on millennial (ages 22-39) homeowners, especially “firsts” living in their first homes. The online survey was conducted Sept. 16-30, 2016 of 605 millennial homeowners. RELATED: Cleaning hacks for the home

The American Dream still includes home ownership for 85 percent of millennials (ages 22-39), according to the survey, but they’re not necessarily willing to go into major debt to achieve it. Only half are willing to pay what it takes to get their ideal features and quality, and only 36 percent are willing to go into debt to afford it. The other half of first-time millennial home buyers opt for older houses that need some degree of repair or remodeling.

“Millennials and millennial “firsts” are paving their own paths in homeownership based on their own budgets, timeline and needs,” explains Jill Waage, digital editorial director at Better Homes in a statement. “These ‘firsts’ are replacing big-budget homes and expensive renovations with patience, frugalness and practicality.” RELATED: Three solutions to winter hair woes

When it comes to home improvement, only a quarter call a professional while the rest try to tackle the project themselves.

As for their eventual dream home, millennials continue to keep it conservative. The ideal sized home is about 2,100 square feet, with renovated kitchens (64 percent), renovated bathrooms (60 percent), and deck/patio space (59 percent) cited as important amenities.

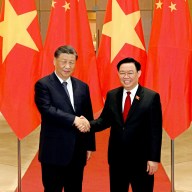

Millennial home buyers avoid debt and prefer to DIY

iStock